A whole lot more states are considering new e-cigarette taxes according to Americans for Tax Reform (ATR).

State-affairs manager at ATR Paul Blair writes that at the end of 2015 half the country and the District of Columbia considered taxing vapor products – up from 15 states in 2014.

According to Blair, the drive to tax e-cigarette products is not about public health but is instead about protecting the government’s revenue stream from smokers.

Smokers often pay large amounts of tax, so switching from smoking to vaping could hammer the coffers of state governments, giving lawmakers an incentive to make switching increasingly unattractive, Blair argues.

“The same people who spent years demonizing smokers and cigarettes turned around and gleefully pushed for new programs and spending projects with the revenue they were able to extract from consumers… Budgets, though, rely on this significant revenue stream. Here the fraud that has always been the public-health push for cigarette taxes is exposed, in their quest to tax e-cigarettes out of existence,” Blair and ATR president Grover Norquist wrote in National Review.

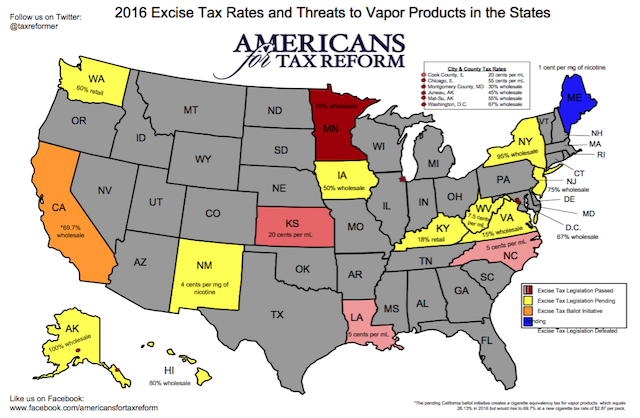

ATR has produced a map showing what holds for vapers in 2016 and what parts of the country, so far, are preparing to penalize vapers through the tax system and where these measures have been defeated.

(Credit: Americans for Tax Reform)

Measures to raise taxes on e-cigarettes have already been filed in Alaska, Hawaii, Iowa, Kentucky, New Jersey, New Mexico, New York, Virginia, Washington, and West Virginia.

Taxes on vapor products have already come to pass in Minnesota, North Carolina, Louisiana, and Kansas the District of Columbia.

On Jan. 1, Chicago hit e-cig users with a fresh Liquid Nicotine Product Tax, charging consumers an extra 80 cents per “liquid nicotine product unit” and 55 cents per milliliter of e-cigarette juice. The vast majority of e-liquid is sold in bottles of 15 to 30-milliliters and the tax will add $8 to $15 per bottle.

Send tips to guy@dailycallernewsfoundation.org

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact licensing@dailycallernewsfoundation.org.