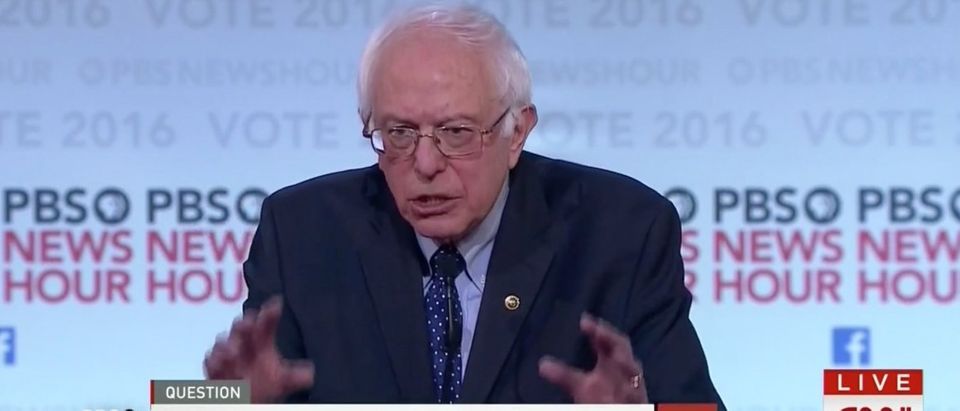

Democratic presidential hopeful Sen. Bernie Sanders proposed lifting the cap on the Social Security payroll tax on those making over $250,000 a year, but economists argue the move won’t do much to extend the solvency of the program and may cause some negative repercussions on the economy.

Under the Federal Insurance Contributions Act (FICA), just the first $118,500 of income is taxed at 6.2 percent, with employers paying the other 6.2 percent. Sanders claims eliminating the taxable maximum would solve the program’s solvency issues for the next 50 years, but according to the nonpartisan Congressional Budget Office, lifting the cap would solve less than 50 percent of the long-term imbalance.

“There are plenty of reasons why removing the cap on FICA taxes is not the cure-all that campaign-trail rhetoric from Sen. Sanders claims it would be. For one, Bernie (and Hillary for that matter) is proposing to expand Social Security and other social programs in a number of ways,” Pete Sepp, president of taxpayer advocacy group the National Taxpayers Union, told The Daily Caller News Foundation. “According to our tracking project at www.candidatecost.org, in just one of the Democratic candidate debates alone, Sanders offered Social Security expansion proposals that would increase annual federal spending by more than $10.5 billion.”

The Democratic candidate said he plans on expanding the program, which is expected to run out of money in 2033, and the legislation he proposed would bring in enough revenue to, on average, provide seniors with an addition $65 a month.

“What this means is that raising the FICA cap under a Sanders presidency is not necessarily about preserving the solvency of the existing Social Security system, it’s also about making government bigger,” Sepp continued. “But even if there was not an additional cent of government spending on the table, busting the FICA cap would not suddenly ‘fix’ Social Security’s finances.”

Sanders argues from a “moral perspective,” increasing the tax burden on high-income earners is the right thing to do, saying it will help reduce income inequality.

“While liberals complain that the payroll tax is ‘regressive,’ our extremely ‘progressive’ income tax tilts the overall federal tax system hugely in favor of low earners,” Chris Edwards, director of tax policy studies at the Cato Institute, told TheDCNF. “CBO data, for example, shows that the highest one-fifth of households pay an average overall federal tax rate of 23 percent, while the bottom one-fifth of households pays an average rate of just 2 percent.”

According to Curtis Dubay, senior fellow at the Heritage Foundation, the move would indirectly hurt low- and middle-class Americans due to the negative impact it would have on economic growth.

“Lifting the cap would raise marginal tax rates on those effected by 15.2 percentage points. This would greatly curtail the incentive to work and slow the economy,” Dubay said. “Middle and low-income families would experience less opportunity because there would be fewer jobs and lowers wages for all Americans as a result.”

The cap was initially put in place to ensure no one was contributing more “than the protecting they received,” according to the Social Security Administration.

“Raising payroll taxes on higher earners will induce them to reduce work and avoid the tax man more, and that will cut both payroll and income tax revenues,” Edwards said.

Sanders’s overall economic plan has received strong criticisms from both political parties, with four former Democratic White House advisers coming out against his policies Wednesday, saying they are unrealistic and not supported by economic evidence.

Follow Juliegrace Brufke on Twitter

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact licensing@dailycallernewsfoundation.org.