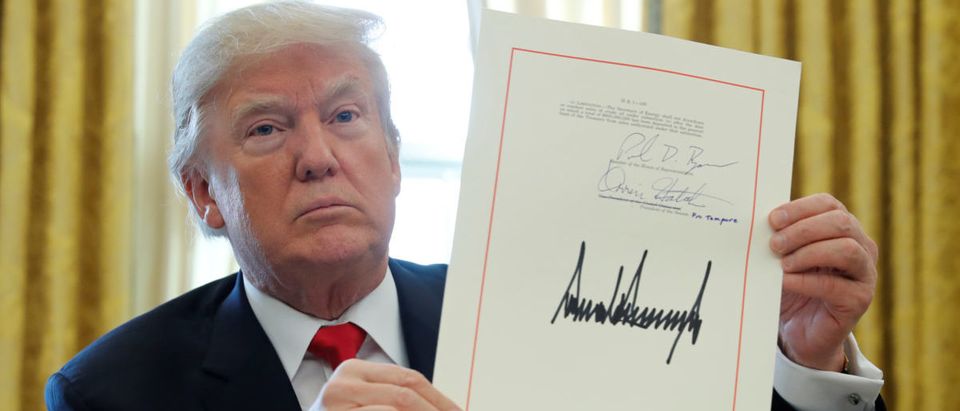

The Republican tax bill President Donald Trump signed into law in the final weeks of 2017 is expected to bring nearly $2 trillion in capital held overseas back to the United States, according to a United Nations Conference on Trade and Developments report released Monday.

The U.N. expects the Republican tax law could lead to the repatriation of roughly $2 trillion in funds that American multinationals are holding overseas. U.N. analysts attribute their predictions to the dramatic cut to the U.S. corporate tax rate that took effect on Jan. 1, 2018.

Trump and Republican leadership in Congress were able to successfully pass the most comprehensive rewrite of the U.S. tax code in 30 years last December. The bill slashed the corporate tax rate from 35 to 21 percent.

Prior to the recent reforms, the U.S. had the highest corporate tax rate of all Organization for Economic Co-operation and Development (OECD) nations and one of the highest in the world, causing American capital flight for decades. Since 2005, large U.S. firms have kept some $3.2 trillion overseas. The worst offenders are in the tech, pharmaceutical and engineering sectors.

For the better part of the past four decades, companies chose to defer their tax payments overseas to areas that have more favorable tax rates. Ireland has historically been a tax haven for many U.S. firms, including Apple, although the European Commission is increasingly cracking down.

Apple–one of the prime offenders of capital flight to get more favorable tax rates–is already changing its investment strategy in the wake of the tax bill. The company announced in mid January that it will pay a one-time, $38 billion tax on its overseas cash stores and promised to dramatically increase investment and spending in the U.S. Apple even attributed its decision to the new tax law.

Along with its other commitments, the company said it will contribute $350 billion to the domestic U.S. economy over the next half decade.

Other companies are responding to the tax bill through increasing employees’ wages, doling out bonuses and bolstering benefits packages. Walmart, AT&T, American Airlines, Disney and over 300 other small and large businesses have announced bonuses, pay raises and/or increased benefits since Trump signed the tax reform bill.

Some of the increase in wages and benefits on the part of companies is being accompanied with layoffs or other restructuring efforts as firms try to navigate the new tax environment.

While taxpayers are only now starting to see the effects of the bill on their weekly paychecks, Americans’ support for tax reform is soaring, growing nine percent in favorability since Christmas.

Forty-six percent of Americans either strongly or somewhat approved of the law as of early January, compared to just 37 percent when the bill was entering the final stages of debate in late December.

Americans aren’t the only ones whose outlook is getting rosier following the tax bill.

The Atlanta Federal Reserve Bank is predicting 5.4 percent GDP growth for the first-quarter of 2018, up over one percent from its original Jan. 29 first-quarter prediction. 5.4 percent growth would be the highest growth rate since the third quarter of 2003.

The U.S. economy grew at a 3.2 percent annual rate in the third quarter of 2017, posting the best back-to-back quarterly growth rates in three years. Fourth-quarter growth rates fell slightly to 2.8 percent.

Follow Robert Donachie on Twitter and Facebook

Send tips to robert@

Freedom of Speech Isn’t Free

The Daily Caller News Foundation is working hard to balance out the biased American media. For as little as $3, you can help us. Make a one-time donation to support the quality, independent journalism of TheDCNF. We’re not dependent on commercial or political support and we do not accept any government funding.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact licensing@dailycallernewsfoundation.org.