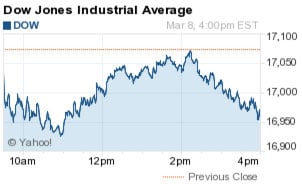

Thanks a lot, China, for ruining Wall Street’s longest daily win streak since October. The Dow Jones Industrial Average ran out of gas after Beijing released its worst exports report since the height of the 2008-2009 financial crisis that saw global trade plummet. Markets are expecting the People’s Bank of China will again join the European Central Bank in its ruthless pursuit of creating any growth through desperate monetary policy measures.

Here’s what you might have missed in the markets for Tuesday, March 8, 2016.

First up, check out the results for the Dow Jones, S&P 500, and Nasdaq:

Dow Jones: 16,964.10; -109.85; -0.64%

S&P 500: 1,979.26; -22.50; -1.12%

Nasdaq: 4,648.83; -59.43; -1.26%

Now, here’s the top stock market news today…

DJIA Today: Oil Slips, China Sinks, and the Fed Goes into Hiding

Oil prices declined after Kuwait poured cold water on expectations for a global production freeze and Goldman Sachs Group Inc. (NYSE: GS) warned about a premature surge in energy commodity prices. WTI crude prices fell 3.7% to $36.50, while Brent crude tumbled 2.9% to $39.65. But even if oil prices see a downturn in the short term, Money Morning Global Energy Strategist Dr. Kent Moors sees oil prices heading higher. Here’s how you can profit from the “Great Oil Turnaround of 2016.”

In political news, it’s another busy day for voters in primary season with Hawaii, Idaho, Michigan, and Mississippi in focus. The biggest prize for Republican and Democratic politicians will be Michigan. The busy primary day comes as former New York City mayor and technology billionaire Michael Bloomberg announced he will not seek an independent bid on concerns that his candidacy would lead to Congress deciding the election.

The economic calendar was extremely quiet today, with U.S. Federal Reserve members going into hiding during the blackout period leading up to next week’s FOMC policy meeting. Today’s biggest domestic report was small-business owner sentiment, which fell last month to its lowest level in two years. A survey of 5,000 business owners raised concerns about shrinking margins, falling confidence in the economy, and concerns about the political landscape.

The big talk today centered on weak Chinese trade data. Exports fell for the eighth consecutive month, renewing concerns about stagnating growth in the global economy. Exports fell 25.4% in February, well worse than the 15% decline that economists had anticipated. But it wasn’t just exports that slowed. Last month, China’s demand for imports fell 13.8% on an annual basis, news that dramatically impacts the economies of countries like Australia and New Zealand, which count the world’s second-largest economy as their top customer.

Now, let’s look at the day’s biggest stock movers and today’s top profit play…

Top Stock Market News Today

- For some investors, Apple Inc. (Nasdaq: AAPL) is spending way too much time in court these days. AAPL stock slipped 0.8% on news the Supreme Court will not hear the tech giant’s appeal of an antitrust case that will force the firm to pay $400 million to e-book consumers. Meanwhile, the company is locked in a high-profile battle against the FBI over whether it must unlock iPhones tied to a drug case in New York and a terrorist attack in California.

- Meanwhile, shares of Seadrill Ltd. (NYSE: SDRL) cratered 20.3% after a major rally in recent sessions following a major short squeeze. The firm’s CEO said this morning that banks are expected to begin refinancing in the second quarter, and traders who have been shorting SDRL stock are “beginning to panic.”

- Merger mania has been all the rage in the markets over the last year. But today, one of the largest deals in the alternative energy sector has fallen through. Rooftop solar panel firm Vivint Solar Inc. (NYSE: VSLR) announced it ended an agreement that would have enabled a takeover by SunEdison Inc. (NYSE: SUNE). The deal, which SunEdison failed to conclude, would have been worth roughly $2.2 billion.

- After the bell, keep an eye out for an earnings report from AeroVironment Inc. (Nasdaq: AVAV), which saw its stock fall 0.3% ahead of its quarterly update.

- Finally, here is your stock pick of the day. The global economy is a mess, but instead of admitting the mistake and trying structural reforms, politicians and bureaucrats have come up with yet another crackpot idea to spend their way to growth. That means there’s likely some serious “helicopter money” stimulus headed our way. It might not achieve growth, either, but it is going to be a powerful profit catalyst for the investment that Money Morning Resource Investing Specialist Peter Krauth wants to show you today. Here it is…

What Investors Must Know This Week

- These Four Charts Have Every Wall Street Pro Worried

- Grab Double-Digit Gains with This Tech Overachiever

- The One “Investment” You Can’t Afford to Be Without

Follow Money Morning on Facebook and Twitter.

About Money Morning: Money Morning gives you access to a team of ten market experts with more than 250 years of combined investing experience – for free. Our experts – who have appeared on FOXBusiness, CNBC, NPR, and BloombergTV – deliver daily investing tips and stock picks, provide analysis with actions to take, and answer your biggest market questions. Our goal is to help our millions of e-newsletter subscribers and Moneymorning.com visitors become smarter, more confident investors.To get full access to all Money Morning content, click here.

Disclaimer: © 2016 Money Morning and Money Map Press. All Rights Reserved. Protected by copyright of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including the world wide web), of content from this webpage, in whole or in part, is strictly prohibited without the express written permission of Money Morning. 16 W. Madison St. Baltimore, MD, 21201.