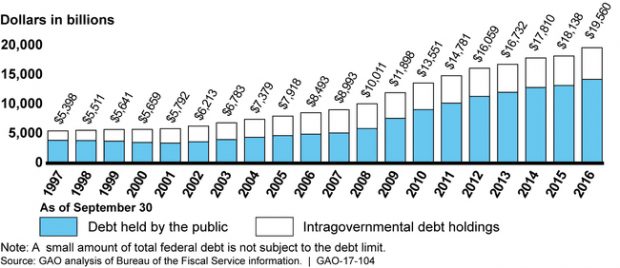

The federal debt nearly doubled under President Barack Obama, with most of it borrowed from U.S. taxpayers, a report from the Government Accountability Office shows.

The total federal debt remained fairly flat, under $6 trillion, through 2001, but nearly doubled to more than $10 trillion by the end of former President George W. Bush’s two terms.

Under Obama, the total debt nearly doubled again, ending 2016 at more than $19.5 trillion, according to an annual audit of the U.S. Treasury’s Bureau of Fiscal Services.

Outstanding federal debt, 1997-2016. (Image: Government Accountability Office)

To put the chart in perspective, if the $19 trillion debt was divided equally among every living person in the U.S., including children, each person would owe $58,000.

The difference between the two types of debt indicate how the government is borrowing money. Publicly-held debt is the amount of money the government has borrowed to finance deficit spending. A lot of that debt is held by foreign governments, though this GAO audit only looked at how the government is managing its debt.

“Debt held by the public and intragovernmental debt holdings are very different,” the GAO says. Essentially, public debt “represents a claim on today’s taxpayers and absorbs resources from today’s economy,” but intragovernmental debt is “a claim on taxpayers and the economy of the future.”

Congress tries to curb spending by implementing a debt ceiling, but as the government approaches each limit and agencies begin worrying about a federal shutdown, the U.S. House and Senate usually pass legislation raising or suspending the cap. (RELATED: Secret Fed Docs Show Obama Misled Congress, Public During Debt Limit Crises)

The current debt ceiling has been suspended until March 17, 2016.

The annual crisis surrounding raising the debt ceiling is counterproductive, the GAO said in its audit of federal debt management.

Rather than argue about raising the debt ceiling every few years, perhaps Congress should think about what spending they approve, the GAO says. Congress “should consider alternative approaches that better link decisions about the debt limit with decisions about spending and revenue at the time those decisions are made,” the GAO recommends.

Follow Thomas Phippen on Twitter

Send tips to thomas@dailycallernewsfoundation.org.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact licensing@dailycallernewsfoundation.org.