When Dodd-Frank was enacted, we were told it was necessary to rein in the bad actors from Wall Street that brought the economy to its knees in 2008. Nearly 10 years later some of the largest banks are experiencing record profits while smaller institutions, like credit unions and small banks, are laboring under regulatory burdens never intended for them.

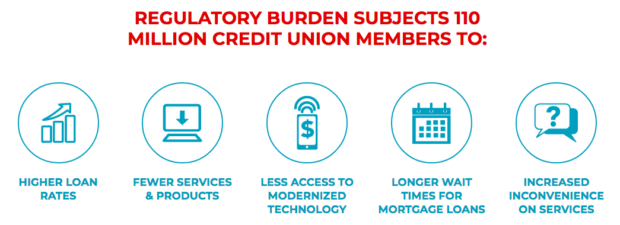

By serving small businesses to first-time home buyers and everything in between, credit unions and small banks are the backbone of our communities. Unfortunately, more and more of their time is spent on compliance – dealing with regulations intended for Wall Street that keep making it harder for these local institutions to serve their communities.

The unintended consequences of this regulatory regime have had such a disparate impact on small lenders that even Democrats have started to reevaluate the burdens they wrote into law. Last week, the Senate Banking Committee passed a bill that would start to address the effects of one-size-fits-all regulating. The Senate Economic Growth bill, S. 2155, helps small financial institutions serve more average Americans by reducing barriers to service and increasing efficiencies. It is carefully crafted to ensure consumer protections are maintained.

The bill shows lawmakers do not have to accept the fallacy that oversight and common sense are mutually exclusive in regulating. If Congress enacts the Senate Economic Growth bill, the process for getting mortgage loans from credit unions will be easier and more straightforward for consumers. The legislation adjusts thresholds that ensure lending regulations intended to rein in Wall Street banks do the job without overburdening Main Street credit unions and small banks. The bill also changes how credit unions designate certain apartment loans, freeing up capital for additional small business lending. Furthermore, it provides important safeguards against elder abuse, giving greater protections to some of the most vulnerable consumers of financial services.

The bill shows lawmakers do not have to accept the fallacy that oversight and common sense are mutually exclusive in regulating. If Congress enacts the Senate Economic Growth bill, the process for getting mortgage loans from credit unions will be easier and more straightforward for consumers. The legislation adjusts thresholds that ensure lending regulations intended to rein in Wall Street banks do the job without overburdening Main Street credit unions and small banks. The bill also changes how credit unions designate certain apartment loans, freeing up capital for additional small business lending. Furthermore, it provides important safeguards against elder abuse, giving greater protections to some of the most vulnerable consumers of financial services.

Two provisions will be especially powerful.

First, easing mortgage origination burdens will both greatly increase market efficiency (allowing loans to close sooner and at lower cost) and reduce borrower frustrations.

Credit union members increasingly complain about closing disclosure rules which all-too-often force re-scheduling of closings when only inconsequential changes are made.

Approximately 4,000 credit unions are active mortgage lenders – they collectively originated $144 billion of first mortgage loans in 2016 alone. As member-owned cooperatives, these institutions stand out as widely-recognized, responsible and consumer-friendly institutions. While credit unions have a limited presence overall, their consumer-friendly approach means they are increasingly important players in the mortgage arena – and have nearly quadrupled their market share of first mortgage originations since the Great Recession (from roughly 2% to approximately 8% of the market).

The Senate bill’s provisions to ease origination burdens would be particularly impactful because credit unions remain focused on serving average Americans. According to current data from the Home Mortgage Disclosure act, relative to other providers, credit unions are making mortgages to households with lower incomes and making smaller loans. For example, the average home purchase loan amount at a credit union is $203,000 – well below the $333,000 average reported by commercial banks.

Because Millennials gained financial maturity during the financial crisis, they’ve been taught that a strict regulatory regime is necessary to protect them from future financial calamity. In fact, these regulations arbitrarily restrict financial choice for much of that population: diminishing options for affordable housing, a tight supply of starter homes and changing lifestyle preferences have many consumers – in particular, would-be first-time homebuyers – gravitating toward rental markets and away from single-family homes. But now rental markets also are under pressure – supplies are tight and rents are rising quickly in many of the nation’s major metropolitan markets.

The second particularly impactful provision of the Senate Economic Growth bill will free up capital for rental units. The bill gives nearly 1,200 of the nation’s credit unions who are active lenders in the multi-family (rental) arena an ability to help. Unlike other lenders these institutions are subject to arbitrary statutory restrictions on their lending for such projects. CUNA estimates that statutory reclassification of 1-4 family non-owner-occupied loans to residential real estate loans would pump nearly $1 billion of additional capital in the rental property arena – giving thousands of working and middle class families the ability to start or expand small rental property businesses and build wealth. And making more affordable rental property options available for tens of thousands more.

The Senate Economic Growth bill provides common-sense reforms that boost economic activity by helping small, local financial institutions improve the financial well-being of average Americans. Congress should pass this legislation.

The Senate Economic Growth bill provides common-sense reforms that boost economic activity by helping small, local financial institutions improve the financial well-being of average Americans. Congress should pass this legislation.

Members of the editorial and news staff of the Daily Caller were not involved in the creation of this content.