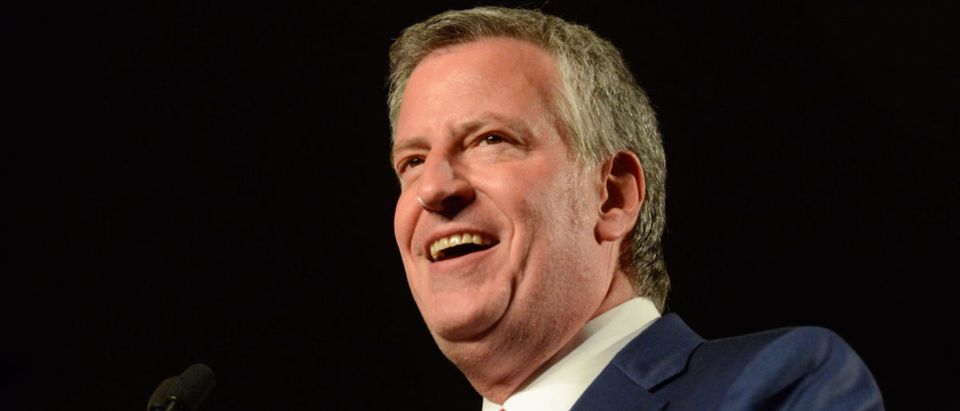

Labor unions are pushing back against New York City Democratic Mayor Bill de Blasio’s proposal to strip billions in oil assets from the city’s pension fund, according to a Thursday Politico report.

New York’s five largest pension boards are savaging de Blasio’s bid to drop Big Oil. The police pension board, which is worried about retirees’ financial future, rejected the idea outright, while the firefighters’ board also tabled the notion. Other NY pension boards are also skeptical of the ploy.

“This should not be funded on the backs of our members and the city members [who] belong to NYCERS,” Subway Surface Supervisors Association Union President Michael Carrube told Politico. His group’s pension is funded through the New York City Employees’ Retirement System — one of the largest pension funds in the country.

Other officials voiced similar concerns. Tom DiNapoli, New York’s comptroller and fierce opponent of divestment, suggested de Blasio’s gamble could be another attack against the state’s beleaguered pension plan.

“We all know that public pension funds are often under attack … so you really need to look carefully at these kinds of questions,” DiNapoli told reporters, referring to the mayor’s wish to strip $5 billion from the city’s retirement funds. “We have to really be concerned about the bottom line.”

Carrube and DiNapoli might have some reason to be concerned. Recent reports show a wholesale selloff could end up costing New York City’s top five pension funds nearly $1.5 trillion over a 50-year time span. The New York City Employee’s Retirement System (NYCERS) would bleed more than $600 billion during that period, according to a 2017 University of Chicago Law School report.

The same report, which Independent Petroleum Association of America partly financed, found the nation’s largest pension fund, California Public Employees’ Retirement System (CalPERS), would also take a huge hit. CalPERS would lose approximately $3 trillion if California enacted a similar divestment plan in that state.

De Blasio, in a bid to save his city from global warming, is also suing Exxon and others for contributing to climate change that supposedly added to Superstorm Sandy, which ravaged New York in 2012, killing 53 people and causing $19 billion in damages.

New York’s recovery included several resiliency projects to strengthen the city against future natural disasters. De Blasio wants the oil companies to pay for the improvements, Politico reported in January 2018 when the mayor announced his lawsuit. De Blasio’s city is not the only one targeting fossil fuels.

Several California municipalities have already launched into lawsuits against energy companies. Local California officials, much like de Blasio, want fossil fuel industry members to pay for weather defenses and infrastructure improvements to their cities in preparation for severe weather.

Oil producers are blasting the lawsuits. Exxon reviewed bond disclosures from the different California cities involved in the lawsuits and found while selling bonds, city officials significantly undersold the severe weather threat compared to the dire language used in the lawsuits.

Follow Chris White on Facebook and Twitter.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact licensing@dailycallernewsfoundation.org.