When the coronavirus pandemic forced most of the U.S. to temporarily shut down, more than 100,000 small businesses closed their doors forever, a new study shows.

Economists are projecting that at least 2% of small businesses in the country will be closed forever as a result of the pandemic, according to an academic study reported on Tuesday by The Washington Post. The Post also reported that 3% of Restaurant operators have gone out of business. (RELATED: Sweden Is Reaping The Benefits After Defying Conventional Coronavirus Wisdom)

“Tearful, heartfelt announcements about small-business closures are popping up on websites and Facebook pages around the country,” Washington Post reporter Heather Long wrote. “Analysts warn this is only the beginning of the worst wave of small-business bankruptcies and closures since the Great Depression.”

The federal government implemented the paycheck protection program in late March, which loans businesses money in order to keep workers on the payroll amid the crisis. Still, the loans have apparently not been enough for many businesses to survive months without generating any revenue. The unemployment rate is at its highest level since the Great Depression, with tens of millions of workers having been laid off over the past two months. (RELATED: FLASHBACK: Jan.21: Fauci Says Coronavirus ‘Not A Major Threat’ To U.S.)

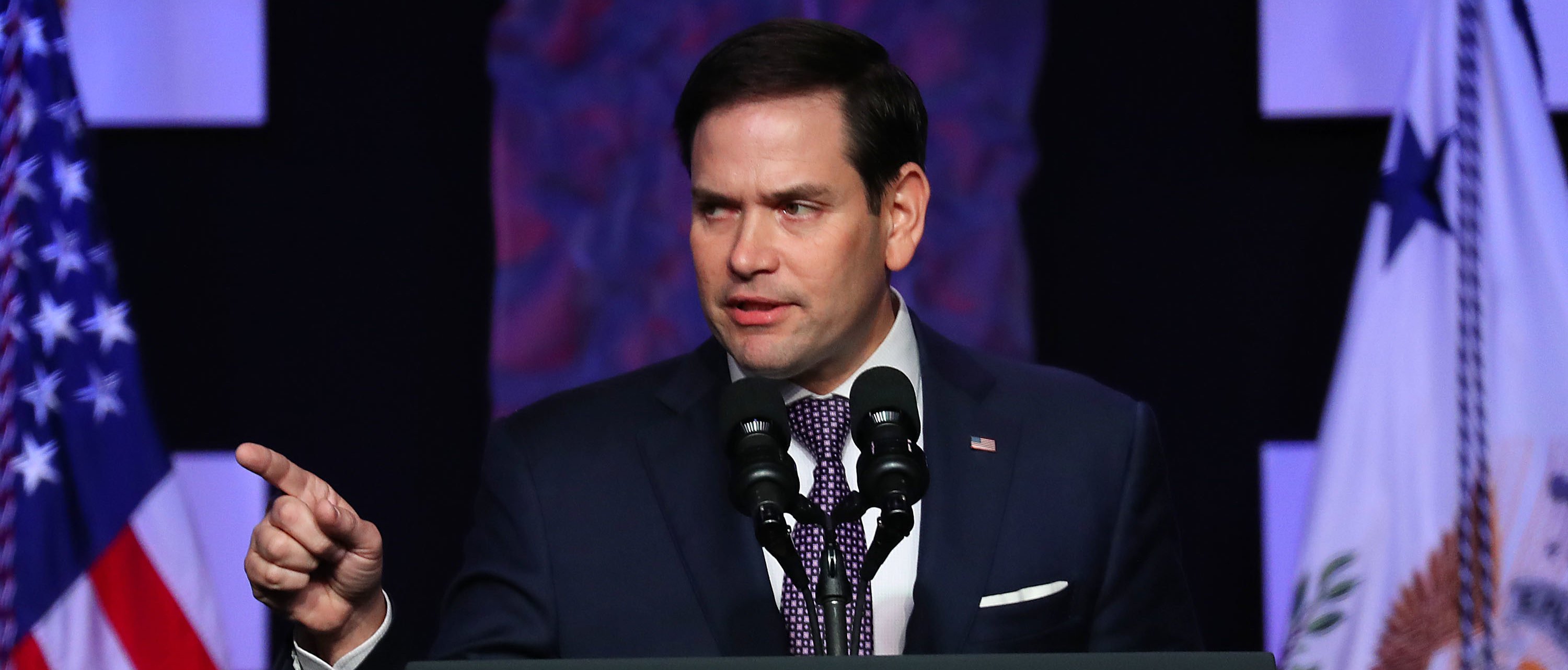

Sen. Marco Rubio (R-FL) speaks before Vice President Mike Pence takes to the podium at Iglesia Doral Jesus Worship Center after meeting with Venezuelan exiles and community leaders on February 01, 2019 in Doral, Florida. (Photo by Joe Raedle/Getty Images)

Republican Florida Sen. Marco Rubio, the chairman of the Senate’s Committee on Small Business and Entrepreneurship, wrote a letter Tuesday to Treasury Secretary Steven Mnuchin and Small Business Association Administrator Jovita Carranza, urging the Trump administration to prioritize the interests of workers during its implementation of the paycheck protection program.

”If a business took a loan and still laid off workers, then it should be presumed that they did not apply for the loan to maintain payroll, but rather as a source of credit on highly favorable terms for a firm of their size,” Rubio wrote.