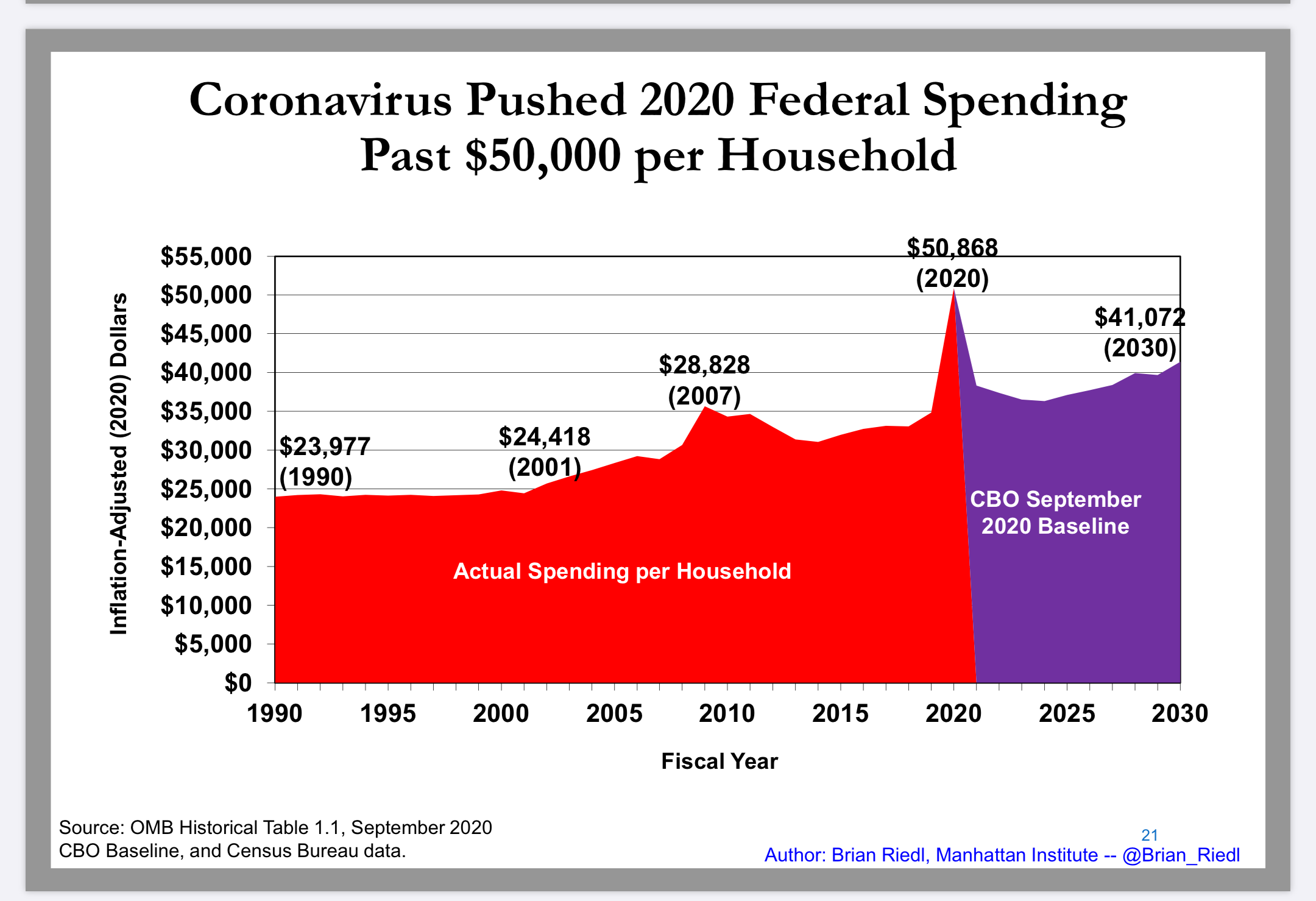

Federal spending per American household increased to a record $50,000 during 2020, according to a budget chart book organized by Brian Riedl, senior fellow in budget, tax, and economics at the Manhattan Institute for Policy Research.

Between spending from the pandemic, Social Security, Medicare, defense and veterans, the amount spent per household increased by $15,000 in one year, according to graphs Riedl arranged, based on publicly available government data.

“Nearly the entire $15,000 per household increase is related to coronavirus. That is the driver of spending,” Riedl told the Daily Caller. “It is by far the highest spending level in American history.”

Courtesy of Brian Riedl/Manhattan Institute

The massive surge in federal spending included a $2.2 trillion stimulus package in March, which distributed $1,200 payments to single Americans who make less than $75,000 a year, $2,400 for families that make under $150,000 a year, and $500 for each child under the age of 17.

Another bill is reportedly in the works — the White House has offered a $1.8 trillion bill, but Democrats want more money, blocking the passage of a stimulus in October. President Donald Trump says the stimulus will happen after the Nov. 3 election. (RELATED: Trump Says Stimulus Package Will Happen ‘After The Election’)

WASHINGTON, DC – OCTOBER 08: Rep. Frank Pallone (D-NJ) and Speaker of the House Rep. Nancy Pelosi (D-CA) during the Weekly News Conference on Capitol Hill on October 08, 2020 in Washington, DC. Pelosi spoke on the uncertainty around negotiations of another emergency COVID-19 relief package. (Photo by Tasos Katopodis/Getty Images)

The chart shows consistent increases in spending per household since 1990, when the amount adjusted for inflation was at $23,977. The chart peaks during times of economic turmoil, like the Great Recession in 2007, when federal spending per household reached $28,828, and the pandemic.

“Federal spending should drop down to about $37,000 per household once the recession and coronavirus ends, but then it ratchets right back up over $40,000 per household by the end of the decade,” Riedl said.

In the next three decades, spending could reach a staggering $62,000 per household, adjusted for inflation, by 2050. The major driver of long-term spending, Riedl said, is Social Security and Medicare.

Medicare is expected to experience the fastest spending growth, 7.6% per year, from 2019-2028, largely because of its high projected enrollment growth, according to the Centers for Medicare & Medicaid Services (CMS). In 2019, the combined cost of the Social Security and Medicare programs was estimated to equal 8.7% of the GDP, according to the Social Security and Medicare Board of Trustees.

The retirement of 74 million Baby Boomers, paired with rising healthcare costs, will drive 90% of federal spending over the next decade, apart from coronavirus, and roughly 98% of the deficit over the next 30 years, Riedl told the Caller.

“Most other parts of the budget are actually not rising that much over the long term. Defense spending has been pretty stable, non-defense discretionary spending has been pretty stable. It’s entirely a Social Security and Medicare issue long term,” he explained.

Many of the millions of Americans who lost their jobs and health insurance due to coronavirus-related shutdowns are enrolling in Medicaid, another public health insurance program that provides health care to low-income Americans. Georgetown University’s Center for Children and Families found a 2.8% increase in Medicaid enrollments between February and April.

Close-up on a red closed sign in the window of a shop displaying the message “Closed due to Covid-19”.

Riedl expects Medicaid rolls to continue increasing, along with food stamps and other means-tested programs. Even if the poverty rate falls, these programs have seen an increase in enrollments during times of relative economic stability.

“The poverty rate was falling before the recession, but you still have SNAP costs and caseloads rising,” he said. “One challenge is that government dependency grows even during good times, but given the recession we’re in and that we may be in for longer than we had hoped, it’s inevitable that government dependency is going to continue to grow, especially in government programs like Medicaid and food stamps.”

Money can’t be pulled from thin air, either, Riedl explained. When federal spending increases, Americans can expect their taxes to rise, too, especially if they’re middle class.

“Ultimately the danger is this: as governments go spend $50,000 per household, eventually they’ll have to tax $50,000 per household. We can’t run $3 trillion deficits, or even $1 or $2 trillion deficits forever. Eventually there’s going to be a day of reckoning when taxes are going to have to rise drastically,” Riedl said.

“If people say ‘who cares if government spending is rising,’ my concern is at a certain point taxes will follow, and if we don’t want to see enormous middle class tax increases, we absolutely have to get spending under control,” he added.