Sam Bankman-Fried fell from grace after almost two years of being indoctrinated into the world of elite Democratic donors as the party’s next George Soros, eager to fund lobbyists, PACs, and media projects.

The Liberal Establishment Thought They Found Their Next George Soros

ANALYSIS

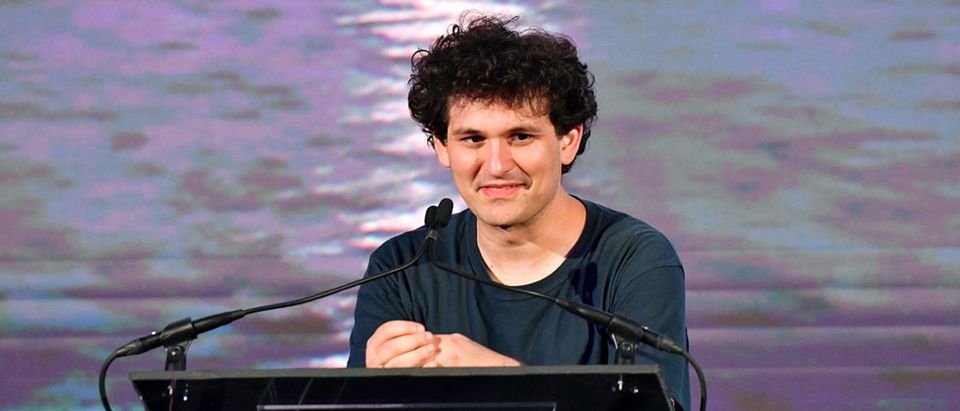

Photo by Craig Barritt/Getty Images for CARE For Special Children

Mary Rooke

Commentary and Analysis Writer

Font Size: