Tax credits to battery manufacturers in President Joe Biden’s signature Inflation Reduction Act may wind up costing more than four times as much as the Congressional Budget Office (CBO) initially anticipated, according to Axios.

The Inflation Reduction Act provides a tax credit of $35 per kilowatt-hour for the production of batteries used in electric vehicles — roughly 35% of the cost to fabricate a cell using current methods — and initial estimates from the CBO pegged the cost of the program as roughly $30.6 billion over the next 10 years. However, following a rash of new battery investments totaling more than $73 billion in 2022 alone, analysts from Benchmark Mineral Intelligence now expect the program to cost at least $136 billion over the next 10 years, with each new investment driving the cost up further, according to Axios. (RELATED: GM To Make $650 Million Investment In Key Nevada Lithium Mine. But There’s A Problem)

Individual companies are poised to rake in billions, with Tesla expecting to earn $1 billion in battery tax credits in 2023 alone, and $17.5 billion between 2023 and 2026, according to Axios. Ford anticipates receiving $7 billion in breaks from 2023 to 2026 before spiking in 2027, while GM expects to earn $300 million in 2023.

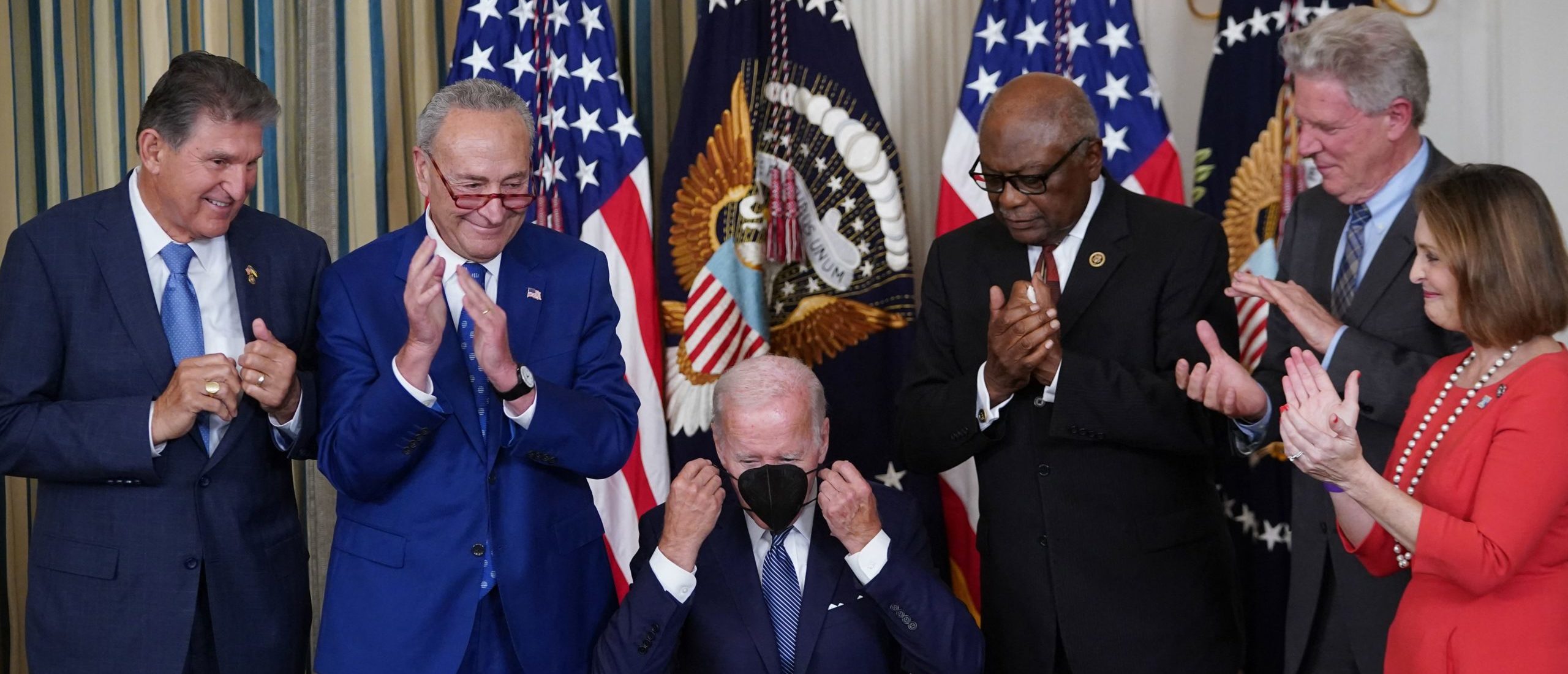

US President Joe Biden puts on his mask after signing H.R. 5376, the Inflation Reduction Act of 2022, in the State Dining Room of the White House in Washington, DC on August 16, 2022. (Photo by MANDEL NGAN/AFP via Getty Images)

“We have already seen hundreds of billions of dollars in new private sector investments across clean energy industries, including batteries, electric vehicles and solar panels,” Michael Kikukawa, White House assistant press secretary, told Axios. “No one should be surprised that the historic Inflation Reduction Act will lead to an explosion in new [electric vehicle] plants that will showcase how American workers are the finest in the world.”

Foreign allies, such as the European Union, Japan and South Korea, have expressed frustration with the new law’s requirement that vehicles be manufactured in the United States to qualify for a $7,500 consumer tax credit. Foreign automakers like Japan’s Honda and South Korea’s Hyundai announced plans for multibillion dollar electric vehicle manufacturing plants in the U.S. in 2022.

Electric vehicle sales surged in 2022, but recent price cuts on electric offerings from Ford and Tesla have left some investors questioning if demand will remain robust in 2023.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact licensing@dailycallernewsfoundation.org.