Just eight electric vehicles and two plug-in hybrids will qualify for the Biden administration’s signature $7,500 consumer tax credit when stricter battery-sourcing rules go into effect Tuesday, according to data from the IRS.

This limited list is a dramatic reduction from the more than 100 models that qualified for a full $7,500 consumer tax credit in 2022, and roughly halves the number that had qualified since the start of the year while the Treasury Department finalized its rules, Bloomberg reported. The strict sourcing requirements — which have been a point of contention between the U.S. and several allies — require at least 40% of the critical minerals in an electric vehicle’s battery to be mined and processed in the U.S., or a country with which the U.S. has a free trade agreement, in order to qualify for half of the $7,500 tax credit, with at least 50% of the battery be assembled in the U.S. to qualify for the other half. (RELATED: Biden Admin Releases Strictest-Ever Car Emissions Regulations)

The ten fully eligible models hail from just four firms — General Motors, Tesla, Ford and Stellantis — with the latter three also owning the seven additional vehicles that will qualify for half-credits, according to IRS data. Industry titans including Volkswagen, Hyundai, Nissan, BMW and Volvo, alongside startup Rivian, are all set to lose access to outstanding partial credits Tuesday when the sourcing rules go into effect, Bloomberg reported.

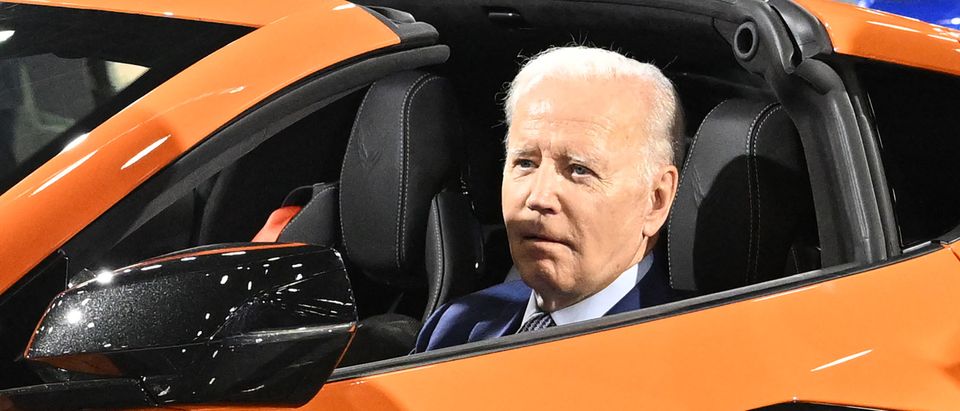

WASHINGTON, DC – AUGUST 11: U.S. President Joe Biden participates in a virtual meeting on Infrastructure Investment and Jobs Act at South Court Auditorium at Eisenhower Executive Office Building August 11, 2021 in Washington, DC. Photo by Alex Wong/Getty Images)

Three of the 10 qualifying electric vehicles, all Chevrolet models, will not be available until the summer or fall of 2023, narrowing consumers’ options further, Bloomberg reported.

The Biden administration expected the new rules to “temporarily” reduce the number of electric vehicles eligible for tax credits, but expects the number to rebound and then increase over the next decade thanks to new investments in U.S.-based manufacturing, Politico reported when the rules were first announced in March, citing an anonymous senior administration official. In total, companies have announced $52 billion in projects related to electric vehicle and battery manufacturing, Bloomberg reported.

The Biden administration did offer a concession to automakers by exempting leased vehicles from the sourcing requirements, a change that Hyundai and Rivian lobbied for, according to Bloomberg.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact licensing@dailycallernewsfoundation.org.