The federal government is shelling out $13 billion to take over and sell First Republic Bank to JPMorgan Chase after the regional bank failed over the weekend, but the costs of the process could end up being passed on to average Americans.

The FDIC initially estimated that the cost to its Deposit Insurance Fund (DIF), which protects depositors and resolves failed banks, will be around $13 billion, according to a press release from the FDIC. However, the FDIC will charge fees to banks to recoup its losses, which will eventually be passed on to everyday consumers, E.J. Antoni, research fellow for Regional Economics at the Heritage Foundation’s Center for Data Analysis, told the Daily Caller News Foundation.

“The FDIC gets its money from banks by levying fees and those charges are passed on to customers,” he told the DCNF. “To cover the cost of the three recent bank collapses, the FDIC will be levying a ‘special assessment’ that will ultimately increase the costs customers are paying.”

JPMorgan Chase will also receive $50 billion in financing to complete the deal.

“The FDIC can also get money from the Treasury, where it has an existing line of credit,” Antoni added. “That comes out of the taxpayer’s wallet. The more banks the FDIC bails out, the more expensive this gets for you and me.” (RELATED: Major Bank’s Stock Continues Crashing As It Begs Fed For Aid To Avoid Collapse)

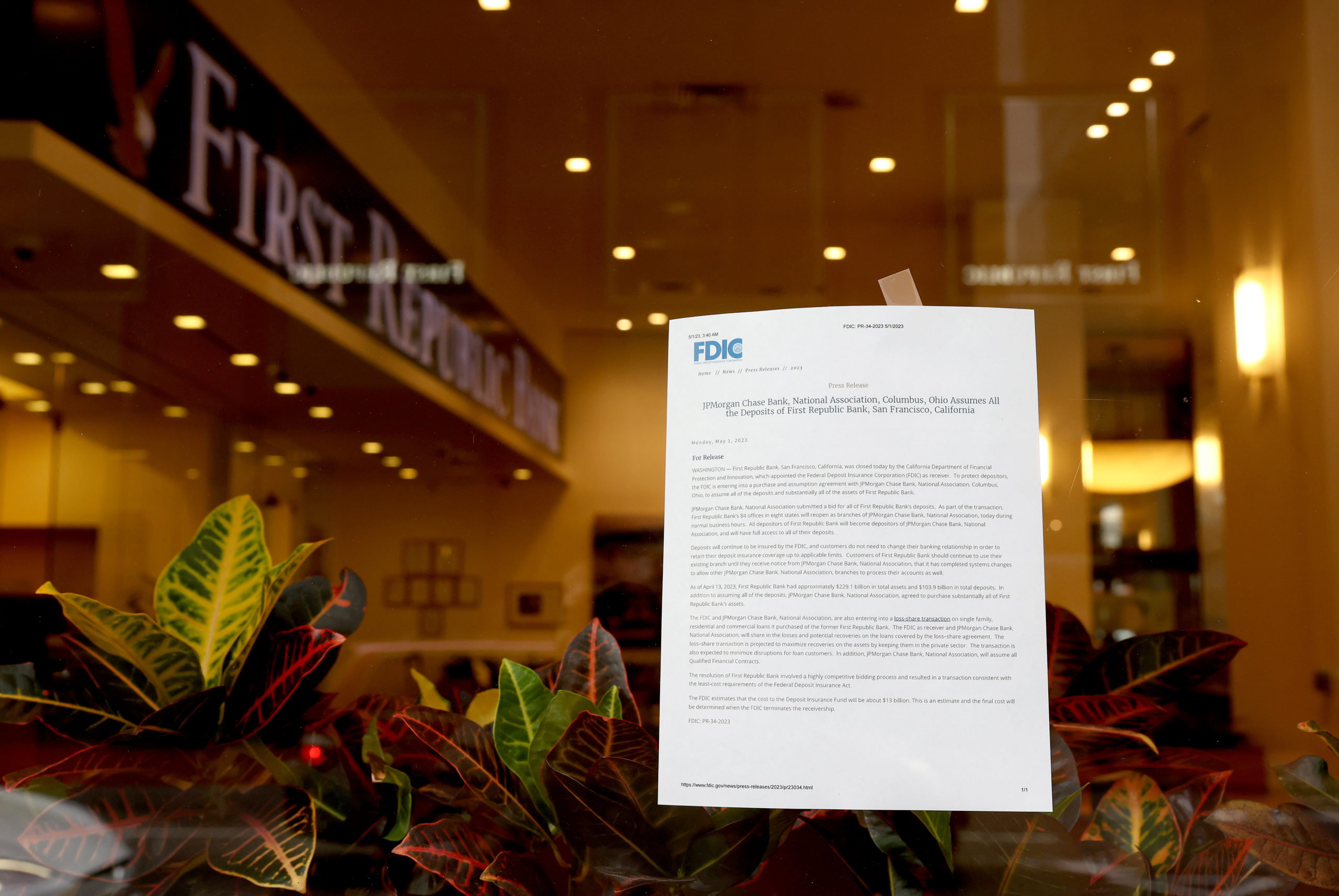

SAN FRANCISCO, CALIFORNIA – MAY 01: A posted announcement from the FDIC about the seizure of First Republic Bank and sale to JPMorgan Chase is displayed on a window at a First Republic Bank office on May 01, 2023 in San Francisco, California. Federal Regulators seized troubled lender First Republic Bank on Monday and sold all of its deposits and most of its assets to JPMorgan Chase. First Republic becomes the second largest bank in U.S. history to fail since Washington Mutual failed in 2008. (Photo by Justin Sullivan/Getty Images)

The FDIC took ownership of First Republic Bank and sold it to JPMorgan Chase on Monday, marking the second-largest bank collapse in American history, and the third bank failure in less than two months.

Dr. Thomas Hogan, senior research faculty at the American Institute for Economic Research and former chief economist for the Senate Committee on Banking, Housing and Urban Affairs, told the DCNF that frequent bank failures could also drain the DIF and require taxpayers to eventually foot the bill.

“The FDIC charges all insured depositors a monthly fee, a portion of which is saved in the Deposit Insurance Fund (DIF),” Hogan said. “When an insured bank fails, the FDIC compensates any losses on insured deposits using funds from the DIF. If many banks fail, the losses may exceed the total funds in the DIF, in which case, the difference is covered by the federal government, i.e. taxpayers.”

President Joe Biden said the agreement between the FDIC and JPMorgan Chase will ensure the banking system is secure in remarks at a National Small Business Week Event on Monday.

“Critically, taxpayers are not the ones that are on the hook,” he said, receiving applause.

First Republic was the 14th-largest commercial bank in the country, according to the Federal Reserve. In addition to receiving all of First Republic’s deposits from the FDIC, JPMorgan Chase acquired the substantial majority of its assets, according to JPMorgan Chase’s press release.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact licensing@dailycallernewsfoundation.org.