Regional bank stocks fell again on Thursday just days after federal officials assured the public that JPMorgan Chase’s purchase of recently failed First Republic Bank would secure the banking sector.

PacWest Bancorp plummeted around 50%, Western Alliance Bancorporation dropped almost 40%, Zions Bancorporation and Comerica Incorporated declined over 10%. First Republic’s collapse was the second-largest bank failure in U.S. history and the third major regional lender to fall this year, but President Joe Biden and Federal Reserve Chairman Jerome Powell said the banking system is sound.

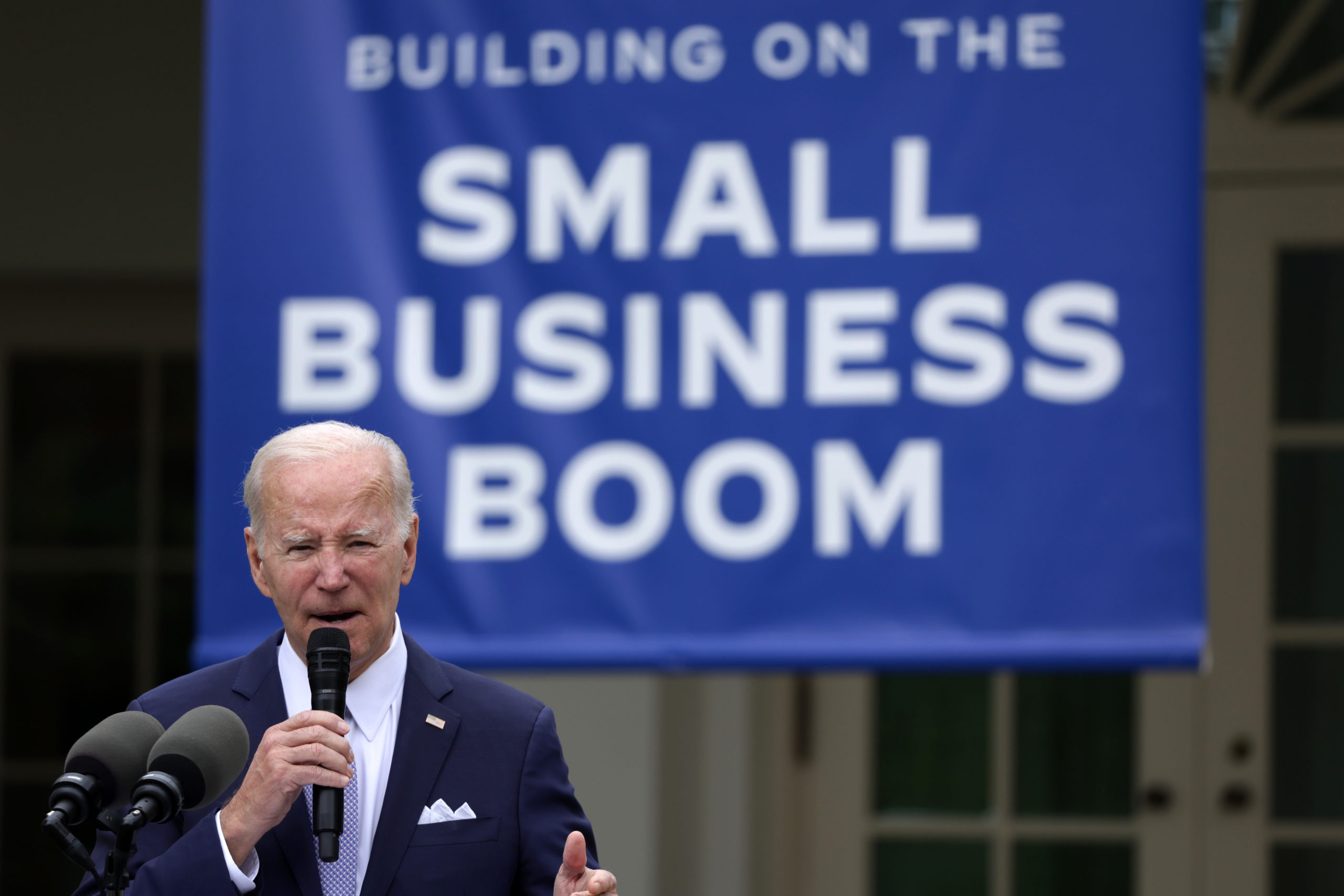

Biden said the FDIC and JPMorgan Chase’s agreement will “make sure the banking system is safe and sound,” in remarks delivered at a National Small Business Week event on Monday. (RELATED: ‘The US Economy Is Unwell’: Wall Street Bigwigs Pour Cold Water On Biden’s Economic Optimism)

WASHINGTON, DC – MAY 01: U.S. President Joe Biden speaks during a Rose Garden event at the White House to mark National Small Business Week on May 1, 2023 in Washington, DC. President Biden is hosting small business award winners at the White House to celebrate their contributions. (Photo by Alex Wong/Getty Images)

Powell said the U.S. banking system “is sound and resilient” in a press conference following the Federal Open Market Committee (FOMC) meeting and resulting decision to hike rates by 25 basis points on Wednesday to the highest level since the 2008 financial crisis.

“In our last financial crisis in 2008, we had a few big banks go under early on and then hundreds of regional bank failures in their wake,” said Peter St. Onge, research fellow in economics at the Heritage Foundation. “So given that we have just had the second, third, and fourth largest bank failures in U.S. history, going by history we are due for a lot more.”

Increasing interest rates can be a problem for regional banks because it makes it more costly to hold deposits and lowers the value of particular bonds and loans, according to CNBC. These issues contributed to the deposit outflow from Silicon Valley Bank (SVB) in March, which rapidly spread to Signature Bank, causing the collapse of both lenders.

The Federal Reserve acknowledged its banking supervisors failed to take sufficient action to solve SVB’s severe issues before its collapse, according to a report by the central bank released on Friday.

America’s 25 biggest banks gained $120 billion in deposits after the failures and rescues of SVB and Signature in March, while smaller banks lost $108 billion in deposits, according to The Wall Street Journal.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact licensing@dailycallernewsfoundation.org.