The U.S. Federal Reserve hired another former executive from Goldman Sachs Group Inc. (NYSE: GS) – Neel Kashkari – on Nov. 10.

Kashkari will be the new president of the Minneapolis branch in 2016. He is the latest in a seemingly endless batch of former GS bankers appointed a major position at the central bank…

In August, the Dallas Fed named former GS Vice Chairman Robert Kaplan as its president. And before that, in March, GS trustee Patrick Harker nominated himself to head up the Philadelphia branch.

With Kashkari’s appointment last month, four of the Fed’s 12 regional branches are run by former Goldman executives (this includes New York Fed’s William Dudley – a former GS chief economist who was appointed in 2009).

While it’s hard to see how the Fed’s selection of four Goldman Sachs bankers conforms to the requirement that its leaders “represent the public” with “due consideration,” (requirements stated in the Federal Reserve Act), there are more urgent reasons to be alarmed by these appointments.

These financial elites hold too much sway over the Fed – and your money…

What to Expect from a Goldman Sachs-Run Federal Reserve

Fed presidents are integral in setting economic policy for the entire country. Yesterday, The Nation noted that when the Fed meets in mid-December, regional presidents will be some of the key decision-makers that determine whether to raise interest rates.

“If the Fed does raise rates – at this gathering or the ones immediately following – they will essentially declare victory on economic recovery.” This victory would be claimed, The Nation continued, in spite of weak wage growth and disparities in unemployment figures.

After a Goldman Sachs-run Fed “economic victory,” the self-congratulating leaders go back to the same thought processes that got us into trouble in the first place.

Consider Goldman’s contribution to the 2007 subprime crisis…

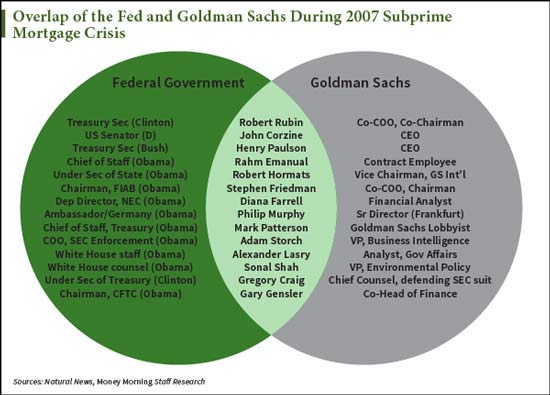

Its failure helped initiate the Great Recession. After the crisis hit, GS heavily benefitted from bailout payments and other fiscal assistance. This Venn diagram released by Harvard law professor and political activist Larry Lessig reveals the connections between our government and banking giant Goldman Sachs:

Considering this evidence of overlap between GS and the government, it’s not surprising that the government adheres to the interests of big banks first before it worries about average Americans’ concerns.

Three central bank presidential vacancies this year provided three opportunities to breathe fresh approaches to monetary policy into the Federal Reserve system. Instead, the Fed remained loyal to its Wall Street ties.

Find out more about the shady collusion between the Fed and Goldman Sachs on our Twitter page @moneymorning and on our Facebook.

How the Fed Killed the Housing Market: Don’t believe the headlines – there is no housing recovery in the United States. In fact, the Fed’s disastrous zero-interest-rate policy has all but decimated the single-family housing industry. These five charts illustrate exactly how damaging that monetary policy has been…

About Money Morning: Money Morning gives you access to a team of ten market experts with more than 250 years of combined investing experience – for free. Our experts – who have appeared on FOXBusiness, CNBC, NPR, and BloombergTV – deliver daily investing tips and stock picks, provide analysis with actions to take, and answer your biggest market questions. Our goal is to help our millions of e-newsletter subscribers and Moneymorning.com visitors become smarter, more confident investors.To get full access to all Money Morning content, click here.

Disclaimer: © 2015 Money Morning and Money Map Press. All Rights Reserved. Protected by copyright of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including the world wide web), of content from this webpage, in whole or in part, is strictly prohibited without the express written permission of Money Morning. 16 W. Madison St. Baltimore, MD, 21201.