We didn’t realize it at the time, but perhaps we should consider Dick Cheney as the godfather of modern democratic socialism. Granted, when Mr. Cheney uttered his now infamous line that “deficits don’t matter” he was in the midst of a reelection campaign and attempting to justify spending hundreds of billions of American taxpayer dollars for two wars, while also providing tax cuts for the American people. Breaking with fiscal and economic policy precedent, the Bush administration was in the business of making us feel we could have our cake and eat it too. Maybe they were right.

Still, Cheney’s maxim, taken to its logical conclusion, begs the question, why should unchecked expenditures stop with endless war? If deficits don’t matter, then why aren’t we also paying for universal health care or free higher education for all?

Economists like Bernie Sanders’ adviser, Professor Kelton of SUNY Stony Brook, have taken notice of the Cheney maxim. In fact, they have built on it, espousing “Modern Monetary Theory” (MMT) — which essentially asserts that balanced budgets are antiquated and countries should provide social goods for its citizens by printing money. Moreover, for the past 20 years, both Democratic and Republican administrations have increased the deficit. The Congressional Budget Office (CBO) now projects a deficit of $3.7 trillion ($1.1 trillion projected prior to the COVID-19 outbreak), while the once powerful “fiscal hawk” caucus calls for spending restraint seem both inert and trite.

As recently as 2000, our country had over a $200 billion surplus. The simple paradigm used to be that independent central banks and the bond market would create fiscal discipline. In other words, there were economic consequences for running a deficit: short term discount rates (controlled by central bankers/FED) and long term rates (dictated by the bond market) would rise as the deficit increased, making the cost of borrowing capital much higher.

On a practical level, this meant that if the FED kept short term rates high, borrowing money for a mortgage or car loan would remain very costly for average people. Similarly, for the US government, if the bond market determined the US was “fiscally irresponsible” and therefore a risky investment, its sovereign debt would be sold. This would drive up the long term rate/yield, making it expensive for the US to service its debt obligations. Under this framework, it is easy to understand why our elected officials had the political will and support of the general public to both preach and attempt to practice fiscal discipline.

In 1997, the US ran only a $22 billion deficit and the bond market had the 10 year Treasury yield averaging 6.35% (meanwhile, the FED had discount rates at around 5.46%) In 1998, the Clinton administration, with the help of a Republican House, achieved a $69 billion surplus and the bond market rewarded us by lowering our debt yield with an average of 5.62% on the 10-year (and the FED had the discount rate at 5.35%). These moves reinforced the common wisdom that surpluses reduced borrowing costs, while deficits increased borrowing costs.

Today, however, the two aforementioned guardrails on deficits have evaporated and the numbers bear this out. In 2019, our deficit had ballooned to $984 billion and the average yield on the 10-year Treasury was only 2.14% (2.16% for short term), thereby eliminating any market forces or monetary discipline to dissuade the US from constantly adding debt (which now exceeds over $20 trillion).

So how and why did we get here? There are two primary reasons: the politicization of monetary policy and the globalization of the capital markets.

Domestic fiscal policy has always, by definition, been political; after all, it is performed by elected representatives. In contrast, the FED, which determines short term rates, should be apolitical. In 2001, though, as we emerged from the 9/11 terrorist attacks knee-deep in a recession, the Bush administration needed to resuscitate the economy. The “home ownership” society was a form of central planning that was going to fuel our turnaround and the Greenspan FED was an integral participant to help juice the home buying spree by keeping rates low.

At the time of Cheney’s famous quip and leading into the 2004 reelection campaign, short term rates stood at 1.5% with a corresponding national deficit of $413 billion. We all know what happened with the housing crisis and the role cheap debt played in the fiasco, but once our society had a taste, there was no going back. Short term rates became a drug that our economy relied on to continue its growth. Quitting cold turkey or, by analogy, slowing an economy by raising rates, was not an option. Elections needed to be won.

The immediate aftermath of the financial crisis under the Obama administration allowed for a moderate stimulus package but our already politicized fiscal policies became even more toxic where fiscal cliffs, the government sequester and “Simpson-Bowles” were used as cheap bargaining chips to the detriment of the American people.

The gridlock of our elected officials to a certain extent forced the FED under Bernanke and Yellen to fill the vacuum and embark on “quantitative easing,” perpetuating our addiction to low rates which never exceeded 1% during President Obama’s entire 8 years in office! Of course a related byproduct of low rates is a soaring stock market, which is wonderful for the 50% of Americans who have any exposure to public equities, but not so great for the other half of the country who saw almost no appreciable gain in wages during the 2008-2016 “recovery.”

Do we really think that Greenspan and his successors were immune to the politics of low rates and the benefits of kicking the can down the road? The French philosopher Jean Jacques Rousseau asserted that men were born good, but corrupted by society. The Fed Chairpeople and the DC Swamp’s influence on them in the 2000s seem to support this thesis.

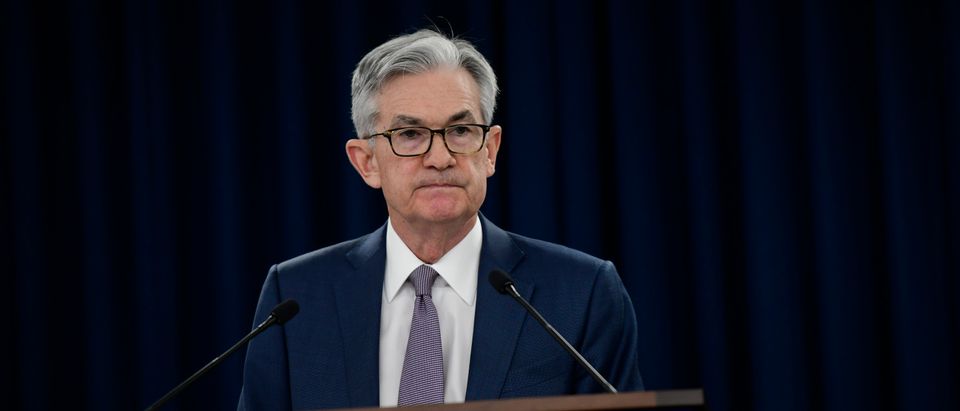

Candidate Trump apparently shared this Rousseauean view when he assailed Chairwoman Yellen for keeping rates artificially low to bolster President Obama. Nonetheless, as president, Trump has attacked his own FED chairman, Jerome Powell, relentlessly for moderately raising rates. In defense of his kindred spirit, the former NY FED Chairman, Bill Dudley (once a tremendously powerful figure), went on record effectively asserting that the FED should not perform its chartered responsibilities in order to prevent Trump from being reelected. Perhaps we can put to bed the fantasy that our FED system is an apolitical body?

As our nation began its dependence on low short term rates in the 2000s, the global capital markets began to evolve in ways that would forever change the sovereign debt market. The rise of Brazil, Russia, India & China (BRIC), maturation of oil rich Gulf nations and the demographic challenges in Europe and Japan increased both sources of capital flows and diversified investment opportunities.

The “bond vigilantes” who kept the US in check in the past now had not only other buyers with whom to compete, but also a plethora of other places to invest. Sovereign debt and corresponding yield payments were now assessed on a relative basis against other countries. There are clear geopolitical reasons why Japan, China and Brazil are three of the four largest foreign holders of US debt. By buying US debt, they keep the value of the US dollar higher than their own currencies; this dynamic keeps their exports to the US market affordable which is beneficial to their own economies. The US consumer is happy to play along with this in exchange for cheap consumer goods manufactured in foreign countries.

More importantly though, where else are investors in search of yield without undue risk going to invest in this new global bond marketplace? In addition to foreign governments, more than 75% of our foreign debt is held by pensions, mutual funds, states, banks, insurance companies, monetary authorities et. al. For example, an underfunded pension in our low short term interest rate environment needs to find a safe return profile, but it cannot look to emerging markets without a secure rule of law and high likelihood of default (see Argentina) despite a potentially high yield — it is too risky. Said pension fund could look to safer geographies like Japan or Europe but they are now in a negative yield environment, leading an investor to a bizarre situation where they compensate a country to hold its money. The reality is that the “full faith and credit” of the US has absolutely no peer. This hegemonic status in the global capital markets has given America carte blanche to run its debt levels as such, with no end in sight.

But the Keynesian and Supply Side economists alike, even if they stipulated the above, assured us there would be a reckoning when the music stopped. The US would be punished at the next economic downturn when the bond market would finally look at our monstrous deficit and sell our bonds, causing our borrowing rates to skyrocket and inflation to take hold in the US the same way it did in the late 70s. Except it didn’t happen.

At the time of this writing, we are in the midst of an economic downturn that dwarfs the 2007-2008 financial crisis and rivals the Great Depression. Yet, the current 10 year Treasury yield is .68%. The current fed funds rate is .05%. You hear that? It’s the sound of silence from the chattering class.

Put simply, there are no longer any economic ramifications for running deficits. So how do we make the best of the new normal? That is to say, if one wants to offer a proper rebuttal to “deficits don’t matter” and its progeny like MMT, then simply calling it “silly” or fear mongering about an Armageddon that will one day come, isn’t compelling or sufficient.

For one, aren’t there both cultural and policy consequences for spendthrift societies? Despite the lack of a foreseeable pecuniary punishment, it is not a virtuous or wise act to burden future generations with extreme debt levels.

For a variety of historical reasons, US “culture,” to the extent which a heterogeneous nation of immigrants which embraces federalism can have one, largely revolves around hard work, innovation and entrepreneurship. These principles have allowed the country to become the most powerful and wealthy nation in the world without asking much — relatively speaking — from its citizens in return. If one attempts to supplant them with programs such as Universal Basic Income which stifle ambition, you begin to undermine our delicate fabric. The social and political freedom we enjoy are derived from America’s standing in the world, and policies that negatively affect our growth and progress must be rejected.

When we begin to accept that monies from the federal government can be used to cure society’s ills, we must also appreciate this will come with strings. To the degree we start allocating expenditures more graciously, particularly around education and health care (two areas where inflation has been immense, commensurate with government involvement) we should never lose sight that our country works best when private and public interests work in tandem, creating competitive schemes while disavowing fraud and abuse.

Hopefully, our collective realization that we can utilize deficits will result in an attempt to equalize opportunity for all Americans, but never outcomes.

Omeed Malik is the Founder and CEO of Farvahar Partners, a boutique merchant bank and broker/dealer which invests partner capital into growth businesses and acts as a liquidity provider of private placements on behalf of companies and institutional investors.