Nancy Pelosi’s husband Paul sold up to $5 million worth of computer chips stock and lost hundreds of thousands after the Daily Caller News Foundation first reported on the businessman splurging ahead of a vote on a bill handing billions to chip manufacturers, according to a financial disclosure.

Paul sold 25,000 shares of Nvidia, one of the world’s largest semiconductor companies, at an average price of roughly $165 each on Tuesday worth up to $5 million, a financial disclosure shows. Paul took a total loss of roughly $341,000, according to the disclosure. (RELATED: Nancy Pelosi’s Husband Buys Millions In Chip Stocks Right Before Vote On Massive Chip Subsidy)

“Mr. Pelosi bought options to buy stock in this company more than a year ago and exercised them on June 17, 2022,” Drew Hammill, deputy chief of staff for the House speaker, told the DCNF. “As always, he does not discuss these matters with the Speaker until trades have been made and required disclosures must be prepared and filed.”

“Mr. Pelosi decided to sell the shares at a loss rather than allow the misinformation in the press regarding this trade to continue,” said Hammill.

Pelosi disclosed on July 14 that Paul bought between $1 million and $5 million worth in stock of Nvidia, one of the world’s largest semiconductor companies, on June 17, the DCNF first reported. The Senate will vote on a bipartisan competition bill Wednesday that delivers $52 billion for domestic semiconductor manufacturing, according to a source familiar with the situation.

Nvidia is a multinational corporation that designs and manufactures graphics processors and other technology, and is heavily reliant on semiconductors. It and other chip companies urged Congress to finalize semiconductor subsidies for domestic manufacturing in June.

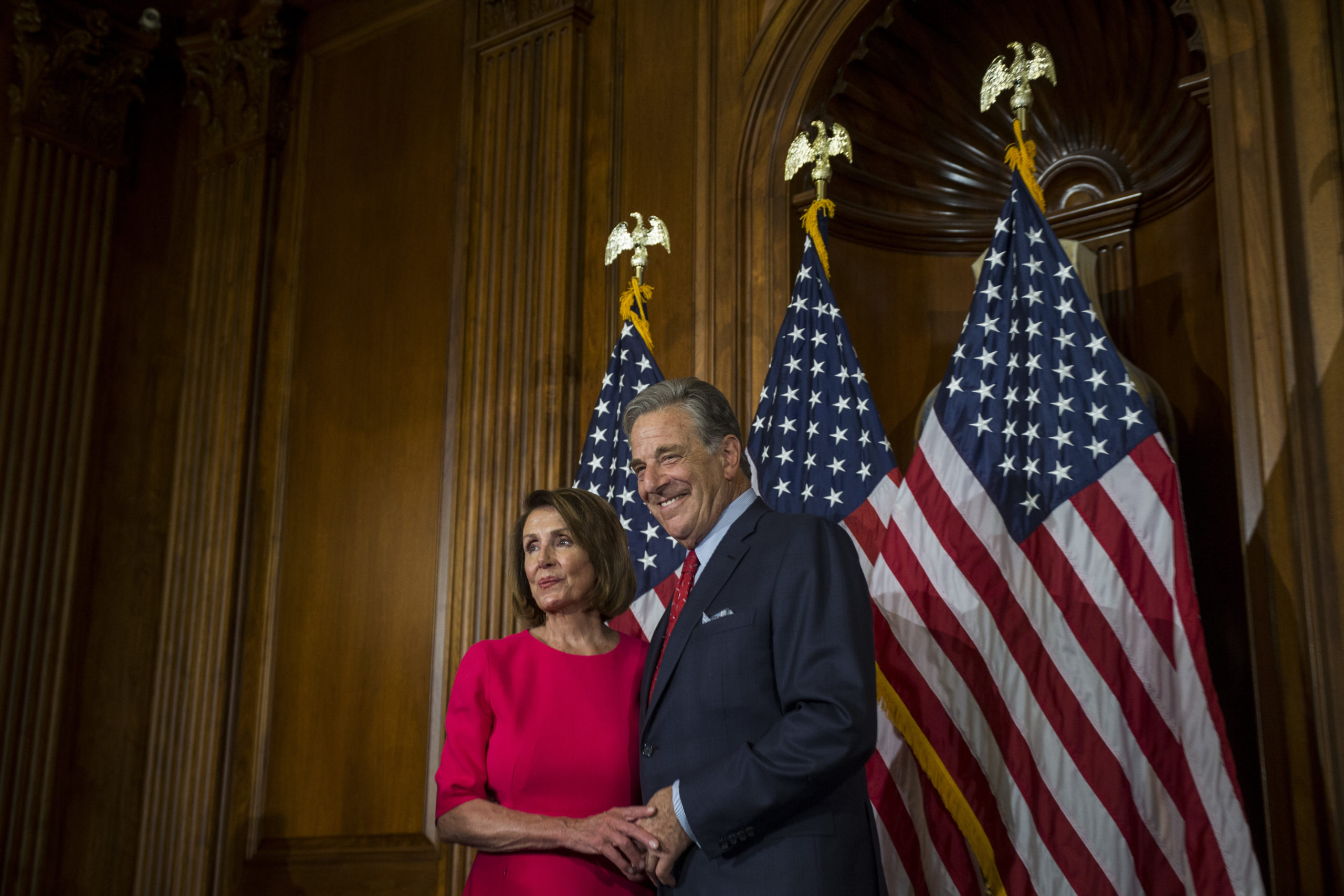

WASHINGTON, DC – JANUARY 03: House Speaker Nancy Pelosi is pictured with her husband, Paul Pelosi, on Capitol Hill on January 3, 2019 in Washington, DC. Under the cloud of a partial federal government shutdown, Pelosi reclaimed her former title as speaker and her fellow Democrats took control of the House of Representatives for the second time in eight years. (Photo by Zach Gibson/Getty Images)

After the DCNF’s report on Paul’s purchase, Hammill told Fox News the house speaker had “no prior knowledge or subsequent involvement in any transactions.”

“To be clear, insider trading is already a serious federal criminal and civil violation and the Speaker strongly supports robust enforcement of the relevant statutes by the Department of Justice and the Securities and Exchange Commission,” the spokesman also said.

Pelosi was asked at her weekly press conference Thursday whether Paul has ever traded stocks based on information she provided him, to which she said, “No, absolutely not.”

Pelosi and her husband have been roundly scrutinized by Republican lawmakers over Paul’s dealings. House GOP Conference Chair Elise Stefanik said the Pelosis’ controversial dealings go beyond Paul’s “investment in domestic semiconductor chip manufacturing,” pointing to Paul’s stock options purchases of social media company stocks while the House speaker “slow walked potential legislation to rein in the power of Big Tech companies.”

Call options are contracts between a buyer and seller for a stock to be purchased at a defined price until a certain date, according to Fidelity Investments. Paul’s call option purchase expired on June 17.

Paul bought over $6 million in Nvidia call options in 2021, filings show.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact licensing@dailycallernewsfoundation.org.