On its face, 2023 was the year that saw American companies scale back their diversity, equity and inclusion (DEI) efforts.

Amazon, Nike, Twitter, Applebee’s, and Wayfair each fired five to sixteen DEI professionals. At tech companies, DEI departments shed a third of their staff. The recruitment of Chief Diversity Officers (CDOs) has declined — diverging from other C-suite position. Some have rejoiced, praising the end of divisive race-based policies.

But the celebration may be premature.

That’s because, like much of the corporate “retreat” from ESG, this withdrawal appears to be in name only. While companies are toning down the rhetoric and reducing headcount, they’re turning up the policies — to the detriment of shareholders.

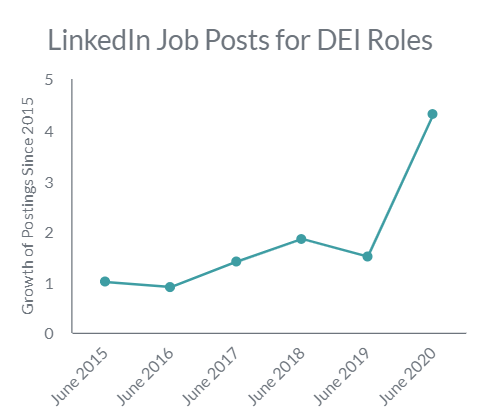

Source: Strive. Data source: LinkedIn; see also https://www.linkedin.com/business/talent/blog/talent-acquisition/why-head-of-diversity-is-job-of-the-moment.

Corporate DEI initiatives exploded in the wake of the 2020 protests as corporate America clamored to show its commitment to social justice. But such initiatives don’t come cheap: U.S. companies spend a staggering $8 billion a year on diversity training. Organizations with 2,000 to 10,000 employees might spend $50,000 to $300,000 on DEI. Fortune 1000 companies often spend much more. Even small and family-owned businesses are increasingly pressured to offer diversity training as a condition for selling to major companies.

The benefits, in contrast, are wanting. Diversity programs often compromise company morale. That’s because diversity trainings blame “dominant groups” for DEI problems, which “may elicit backlash and exacerbate bias.” These initiatives also tend to alienate customers, as both Bud Light and Target learned the hard way. Even customers who are ideologically aligned tend to see through it. One study, for instance, found that only 36 percent of voters believe companies should take social stances. And investors are more critical still: they “want companies to focus on their operations, not the social good.”

Recent court rulings will likely make DEI initiatives even more costly. In Students for Fair Admissions v. Harvard, the Supreme Court held that Harvard’s race-conscious admissions system violated the Civil Rights Act. The Court’s reasoning — that race-based preferences are illegal — equally applies to private companies giving preferences in contracting, training, hiring, promoting, and firing decisions. More lawsuits will surely follow.

A False Retreat

Given this reality, the retreat from DEI initiatives is a welcome change. But that presumes the change is sincere. It’s not.

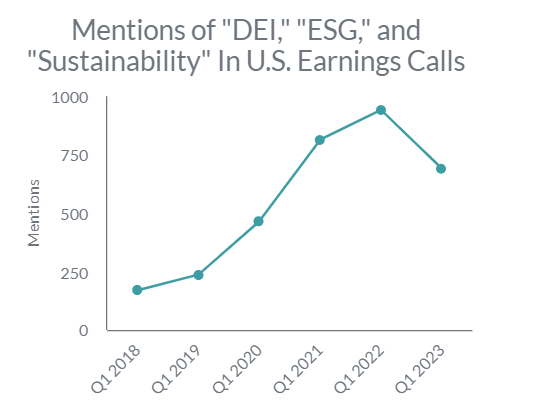

To be sure, CEOs have dropped DEI talk on earnings calls; mentions of ESG and DEI measures have fallen about 30 percent since early 2022. But that doesn’t mean companies have abandoned the policies themselves. They haven’t: “While such instances of ‘green-hushing’ may be part of a larger strategy for many companies to avoid weighing in on divisive issues, there is little sign that public companies are pulling back from the initiatives themselves,” The Wall Street Journal reported in June.

Source: Strive. Data Source: AlphaSense; see also https://www.wsj.com/articles/executives-quiet-their-sustainability-talk-on-earnings-calls-amid-growing-culture-war-3a358c1f

On the contrary, DEI programs are more robust than ever. Amazon, for instance, may have fired sixteen DEI staffers, but it insists that “the firm’s ‘DEI priorities have not changed” and that “the online retailer still has ‘hundreds’ of DEI experts on its payroll.”

Nike similarly may have let a handful of DEI staffers go, but its website touts “Purpose Targets” that include setting aside 35 percent of its U.S. corporate workforce for minorities, requiring executives to obtain DEI credentials, and spending $1 billion with businesses owned by individuals from preferred demographic groups.

Wayfair likewise publishes an annual ESG report, in which it boasts about “flag[ging] use of potentially biased words” by managers and hosting a black-only leadership summit. Not to be outdone, Applebee’s ESG report claims that “diversity, equity, and inclusion” are among its top priorities, ranking even higher guest health and restaurant cleanliness in importance to stakeholders.

In other instances, companies are likely ridding themselves of Chief Diversity Officers not to de-emphasize DEI efforts, but to elevate the role to someone even more senior — a board director. The CDO may be laid off, but DEI gets promoted.

Real change is harder to come by, not just because clever executives believe DEI-hushing will let them have their cake and eat it too, but because the strategy is supported by the large asset managers whispering in their ears. The Big Three — BlackRock, State Street, and Vanguard — are the largest shareholders in 96 percent of Fortune 250 companies. And they’ve spent years pushing portfolio companies to use race-based metrics and promote DEI goals.

They also lead by example. BlackRock, for example, has stopped using the term “ESG,” but remains committed to the practice. Vanguard quietly left the Business Roundtable, which promotes stakeholder capitalism, but continues to vote its clients’ shares in a pro-DEI way. And all three support executive compensation packages that condition CEO pay on meeting DEI goals — a practice at 35 percent of S&P 500 companies. American businesses often feel no choice but to fall in line.

Striving for Better

Strive Asset Management understands that these social imperatives don’t help profitability or customer satisfaction. We manage index funds with an emphasis on best practices in corporate governance in sectors such as energy, semiconductors, and U.S. equities. We proudly put shareholders before all other stakeholders.

Despite the ever-present pressure on companies to prioritize social issues, our commitment to maximizing financial value for our clients is paramount. We advise our portfolio companies against fashionable but unprofitable social imperatives. At the corporate ballot box, we vote against ESG and DEI measures that force companies to waste time and money on programs that harm long-term shareholder value. We hold company management accountable when they pursue these value-destroying initiatives, removing their incentive to view wasteful executive compensation goals as risk-free money.

More broadly, we engage with companies to help them recommit to shareholder primacy. Rather than take orders from large asset managers and special interest groups, companies must listen to their shareholders, who rely on the company’s success to fund their retirements, children’s educations, and homes. Rather than chase social causes, companies must focus on their core missions: make great shoes, entertainment, vehicles, oil, or whatever product or service they’re dedicated to providing. Rather than hire based on superficial metrics, companies should distribute career opportunities according to merit, to whoever would help the company prosper the most.

The collapse of the loud-and-proud DEI strategy was predictable. But we’re not past the melee. Advocates for a financial-maximizing, business-first, colorblind corporate America must remain vigilant to combat DEI initiatives, however loudly or silently they may proceed.

Laura Brady is an Executive Vice President and the Head of Client Solutions at Strive Asset Management, a firm founded by Republican presidential candidate Vivek Ramaswamy and “committed to shareholder primacy.”

The views and opinions expressed in this commentary are those of the author and do not reflect the official position of the Daily Caller.