The U.S.’ national deficit surged in February as income declined and expenses rose, resulting in the federal government spending more than double what it collected in the month, according to a release from the Treasury Department.

The federal government collected $271 billion in February, mostly through taxes and social insurance and retirement payments, but spent $567 billion, a difference of $296 billion that was funded by an increase in the national debt, according to the Treasury Department. The gain in February brings the total national debt increase in fiscal year 2024 to $828 billion, which began in October 2023. (RELATED: Inflation Remains High As Investors Push Back Rate Cut Expectations)

At the end of February, the national debt totaled $34.71 trillion, with $27.38 trillion of that being held by the public and $7.09 trillion being held by other government organizations, according to the Treasury. The federal government recently passed the $34 trillion debt mark right before the start of 2023.

The government has already paid $433 billion in gross interest expenses in fiscal year 2024, far higher than the $306 billion that had been paid at this point in the last fiscal year, according to the Treasury. For the current fiscal year, the Treasury anticipates that it will pay over $1 trillion in just interest costs.

Over 52% of federal gov’t spending in Feb was financed by debt – MORE THAN HALF: pic.twitter.com/GMoTKbTQNx

— E.J. Antoni, Ph.D. (@RealEJAntoni) March 12, 2024

The largest expenses in February were Social Security, which cost $121 billion, and Income Security, which cost $90 billion, according to the Treasury. National defense was the sixth most expensive outlay at $65 billion, just under net interest at $67 billion.

By far the greatest sources of income in the month were social insurance and retirement payments, which totaled $129 billion, and individual income taxes, which totaled $121 billion, according to the report.

In addition to the federal government’s massive debt, the U.S. is also estimated to have over $90 trillion in unfunded liabilities that it is responsible for, which has grown from just over $11 trillion in 2001.

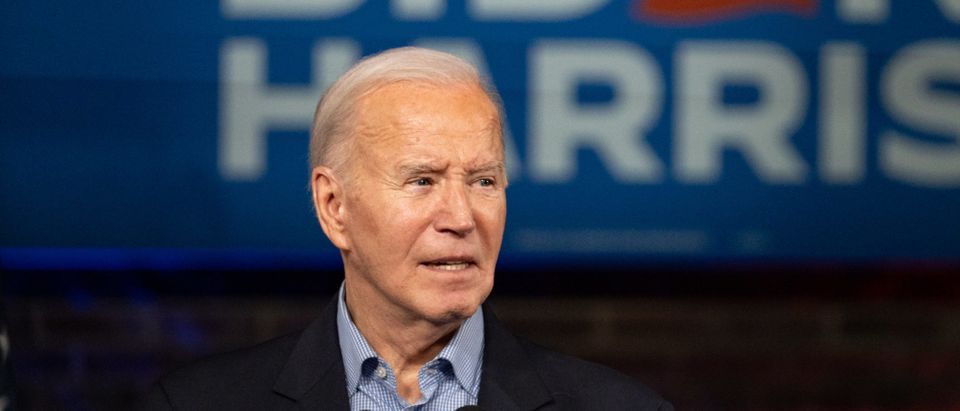

A Biden administration official claimed that 90% of the non-emergency increase in the debt-to-GDP ratio since 2001 has been the result of tax cuts, the official told the Daily Caller News Foundation in response to a request to comment. The official argued that Biden’s recently proposed budget would reduce the national deficit by $3 trillion through taxing wealthy individuals and big corporations.

If President Joe Biden’s budget proposal is enacted, it is estimated that the debt would increase to $42.5 trillion by the end of fiscal year 2028, around the time his presumptive second term would end.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact licensing@dailycallernewsfoundation.org.