Some of the biggest banks in the country who received billions in bailouts during the financial crisis of 2008 have been slow to help small businesses during the coronavirus pandemic, the Washington Post reported Wednesday.

The revelation comes from a recording of a teleconference meeting within the U.S. Small Business Administration that included SBA Nevada district director Joseph Amato. While President Donald Trump’s administration has admitted to some hiccups in the rollout of the $349 billion emergency loan program, Amato says many of the banks the loans are supposed to go through have been slow off the mark. (RELATED: Mitch McConnell Restructures Campaign Into Meals Effort For Kentuckians Affected By Coronavirus)

“There is really no risk to the bank,” Amato said in the meeting. “It just comes down to … the same banks that literally took billions of dollars with one page from [former Treasury Secretary Henry Paulson] are the ones saying the documentation isn’t clear enough for them.”

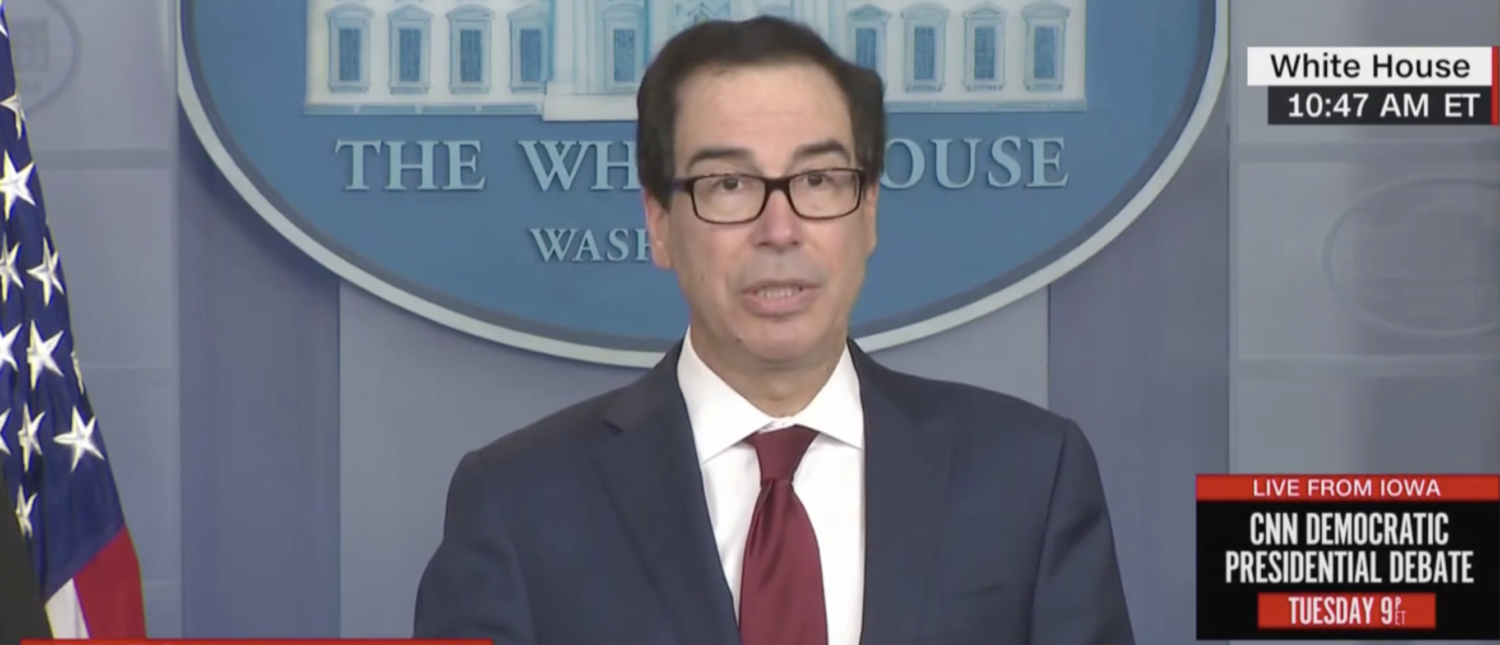

Sec. of Treasury Steven Mnuchin announced the specific sanctions against Iran following missile attacks by the country. (CNN, CNN Newsroom With Poppy Harlow and Jim Sciutto)

Amato did not say banks were willfully leaving small businesses dead in the water, but that they raised objections or requested delays to implementing the program because they didn’t fully understand the logistics.

From the Washington Post:

“Several of country’s largest banks didn’t immediately participate in the program, saying they needed more time to understand how it would operate. And others limited applicants to companies that they already had a relationship with, leaving thousands of small businesses scrambling to find a lender.

Bank of America was alone among big banks to begin processing applications last Friday, earning it praise from President Trump. But the bank angered thousands of small-business owners by initially only taking applications from customers it was already lending to.”

The emergency loan program is part of the three coronavirus relief packages Congress passed since January. The third phase bill afforded hundreds of billions to small businesses and individuals alike. The package totaled more than $2 trillion, and the White house and Congress are already looking to pass a phase 4 relief bill. (RELATED: Pelosi Says Senate Coronavirus Bill Is Discriminatory To Residents In DC, One Day Before House Vote)

The phase 3 bill grants $1,200 payments to Americans making less than $75,000 per year, and $500 for each child under 17.