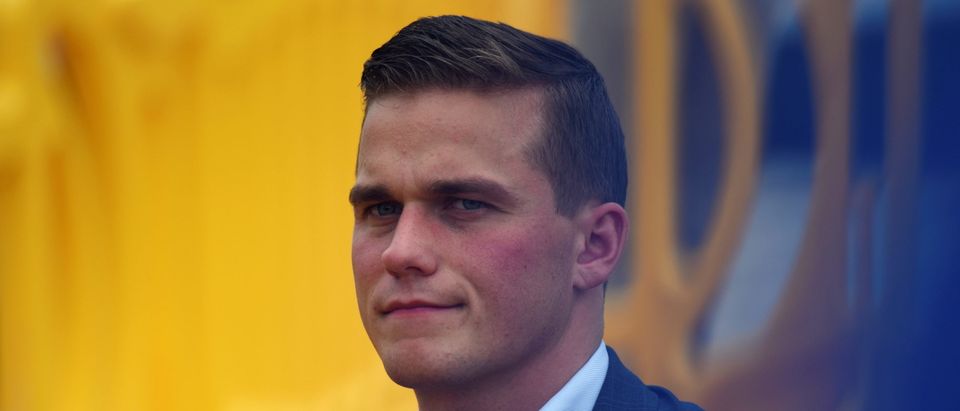

Republican North Carolina Rep. Madison Cawthorn may have violated federal insider trading laws during a reported pump-and-dump scheme.

Multiple watchdog groups told the Washington Examiner that Cawthorn posed for photographs at a party with James Koutoulas, the hedge fund manager behind “Let’s Go Brandon” cryptocurrency, a meme coin set up to mock President Joe Biden. A day after the photograph was taken, the coin’s value skyrocketed, raising red flags about Cawthorn’s potential involvement, the outlet reported.

Koutoulas and Cawthorn have taken multiple photographs together, as seen on Koutoulas’s social media. “Never get sick of a [Madison Cawthorn] bro out,” the manager captioned one such photograph from December 29. “LGB legends. … Tomorrow we go to the moon!” Cawthorn responded to the photograph.

View this post on Instagram

On December 30, NASCAR driver Brandon Brown announced that LGBCoin would be his official sponsor of the 2022 season, Fox News reported. The announcement caused LGBCoin’s value to rise 75%, the Washington Examiner continued. (RELATED: Musk Trolls Trump)

Given Cawthorn’s comment, watchdogs believe that he had prior knowledge of the deal between Brandon Brown and LGBCoin, the outlet continued. “This looks really, really bad,” government affairs manager for Project on Government Oversight Dylan Hedtler-Gaudette, told the outlet, “This does look like a classic case of you got some insider information and acting on that information. And that’s illegal.”

If Cawthorn purchased LGBCoin before Dec. 30, 2021, and had nonpublic knowledge of the deal with Brown, the action would constitute insider trading, according to a government affairs lobbyist for Public Citizen, the outlet noted.

Koutoulas had to relaunch the coin in February and claimed that the second iteration could prevent pump-and-dump schemes, the Examiner continued. Since the relaunch, Cawthorn has spent significant time promoting the coin and his ownership, the outlet reported, sharing Tweets from the coin’s official Twitter account.

“It is not technically or legally possible for a decentralized meme coin that exists to promote free speech and charitable giving to be classified or treated as a security,” Koutoulas told the Examiner. Hedtler-Gaudette pointed out that even if LGBCoin isn’t considered a security, Cawthorn will not be immune from insider trading laws.

“No matter what, though, having advance and nonpublic information that is then used to gain advantage in a financial market (including straight up commodities) is illegal, making my call for DOJ or SEC investigation still operative in this case,” Hedtler-Gaudette told the Examiner.