The new head of the Internal Revenue Service’s (IRS) ethics office once oversaw the illegal shredding of documents sought by the federal tax agency’s inspector general (IG), and allegedly retaliated on the colleague he believed snitched on him about it.

Stephen Whitlock was named director of the IRS Office of Professional Responsibility (OPR) in August 2015. The OPR supports “effective tax administration by ensuring all tax practitioners, tax-preparers, and other third parties in the tax system adhere to professional standards and follow the law,” according to the agency’s web site.

Whitlock’s chief of operations was, until recently, a former tax enforcement agent who attempted to avoid government payments by declaring bankruptcy and who even lost his official sidearm in a bar fight.

Additionally, in this newly-appointed 7-person leadership team are two of Lois Lerner’s former top deputies, at least one of whom was involved in the targeting of conservative and Tea Party non-profit applicants. Records of those activities also mysteriously disappeared after Congress began investigations in 2013.

Earlier in his career, Whitlock was OPR’s deputy director and acting director, but was moved from the office after the 2004 records-destruction and whistleblower retaliation incidents. He was then moved to the head of IRS’s whistleblower office.

When Whitlock returned to OPR in August, he succeeded Lee Martin, who in turn took over Whitlock’s position running the whistleblower office.

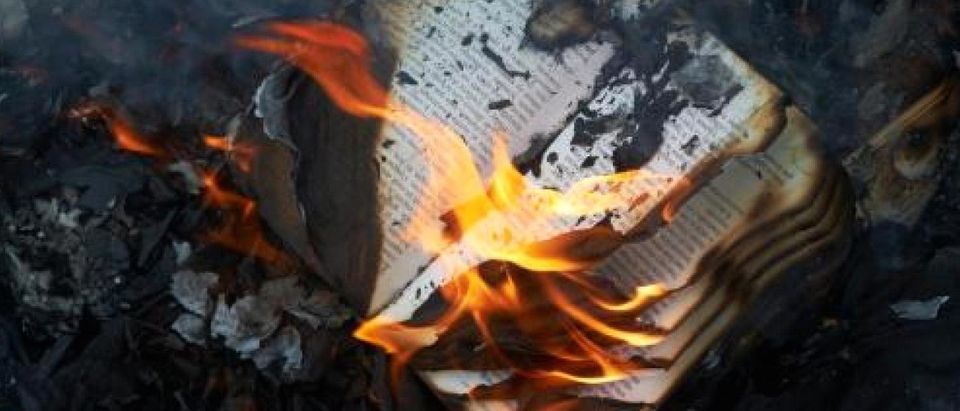

In late 2004, then-OPR associate director Brian Downing, who worked for Whitlock, “ordered the shredding of almost 1,000 taxpayer files a week before … internal auditors were scheduled to review OPR’s case-processing procedures,” apparently to hide that many of the cases had never been worked, according to a June 18, 2014, letter from a group of OPR employees to Congress. A copy of the letter was recently obtained by the Daily Caller News Foundation.

The employee ordered to do the shredding was nervous about breaking federal law and appealed to Whitlock, who ordered her to proceed, the letter said. That’s when someone alerted the IG.

Whitlock forced the employee he thought tipped off the IG to transfer to another office in the IRS. That employee, however, was not the one who talked. The retaliated-against worker filed a complaint that resulted in a monetary settlement, according to multiple former IRS employees interviewed by TheDCNF.

Whitlock then got the IG to search the office computer of another employee who was in fact the tipster and tried to get that person’s security clearance blocked, they said.

The IG sought to prosecute Downing, but he retired, according to the June 2014 letter.

Whitlock was also removed from his job and became head of the IRS whistleblower office in 2007, which rewards citizens who divulge tax scams such as fraud by their employers.

“Perhaps he was credited with his experience in retaliation,” the letter said.

The shredding was successful in impeding the auditors’ ability to assess whether OPR staff was doing its job or letting cases languish. The latter had been indicated by a 2003 audit that found that in two years, it ordered $2.4 million in fines against tax preparers, but only managed to collect $290,000.

The obstructed IG audit was published in 2006, saying “OPR destroyed some referrals in October 2004. OPR officials did not notify the Office of Audit about the destruction of its records … Although the IRS has written procedures for retention and destruction of records, these procedures were not followed by the OPR. There was no log of what records were destroyed, no log of when and how the records were destroyed, and no official written authorization … OPR officials acknowledged that they were required to retain these files for 10 years.”

When Whitlock resumed the helm of OPR in August 2015, his operations director was Bob Johnson, a former tax cop who declared bankruptcy in 2009 and got many of his debts discharged.

In the bankruptcy, Johnson asked to have 50 to 99 debts totaling $74,000 forgiven even though he was at the time earning $140,000 annually working for the IRS, according to court records. Johnson’s wife also worked for the IRS at a similar salary.

Johnson’s assets included a Corvette, a Mercedes and a motorcycle, all less than four years old. He also owned a boat and jet-skis. His debts were discharged in 2014.

Before joining OPR, Johnson worked for the IRS’s inspector general — the same office that attempted to audit OPR — when he lost his gun at a bar in Baltimore, former colleagues told Congress. The next weekend, a felon was found dead in Prince George’s County, Md., with Johnson’s gun in his hands, they said.

Currently under Whitlock are section manager Elizabeth Kastenberg and legal analysis chief Garrett Gluth, both of whom previously worked closely with Lois Lerner in the IRS’s nonprofit tax office. Congressional testimony shows that Kastenberg was in charge of reviewing the audits of conservative-leaning nonprofits and was in the room when major decisions on the political audits were made.

Lerner was subsequently held in contempt of Congress after refusing to answer questions from congressional investigators. The IRS said the records showing her actions in the case had mysteriously disappeared.

In connection with that scandal, then-Acting IRS Commissioner Danny Werfel promised Congress that, as part of a renewed commitment to ethics, all IRS employees would take an ethics course.

The course, given in 2014, was taught by Bob Johnson.

The IRS said it had no comment.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact licensing@dailycallernewsfoundation.org.