A tax loophole that benefits billionaire investors remains largely untouched in both the House and Senate Republicans’ tax reform bills, despite President Donald Trump’s repeated promises to do away with it.

Leaving the provision unchanged effectively means that a home builder or other local business person would pay a higher tax rate on their income than a Wall Street hedge fund manager would pay even on a larger income.

The loophole is known as the carried interest, a feature of the U.S. tax code that allows hedge funders, real estate investors, venture capitalists, and private equity managers to pay taxes at the long-term capital gains rate instead of the rate imposed on the highest bracket of income earners.

Carried interest is the share of total profits from clients’ investments that hedge fund, private equity and a number of other investment managers collect. These firms earn income by collecting a percentage of their client’s profits (most commonly a 20 percent fee on profits). The profits these managers bring in are taxed at the 20 percent capital gains rate (plus a 3.8 percent Obamacare surtax), as opposed to the top rate on ordinary income of 39.6 percent.

The president highlighted the carried interest provision on the campaign trail as something his administration would close because it was letting rich hedge fund managers “get away with murder.”

Secretary of the Treasury Steve Mnuchin promised in mid-September that the tax reform proposal would put an end to carried interest. He also said that it was an issue that only hedge funders cared about, not “the American people.”

The White House tax reform blueprint released in late September did not touch carried interest or the capital gains rate.

White House economic adviser Gary Cohn said the day after the administration’s blueprint rollout that “carried interest is one of those loopholes that we talk about when we talk about getting rid of loopholes that affect wealthy Americans.”

The White House did not immediately respond to The Daily Caller News Foundation for comment.

House lawmakers voted to keep the carried interest provision Thursday afternoon, despite Sen. Ron Johnson of Wisconsin’s opposition to the measure. The bill does throttle the provision somewhat, as it raises the bar on the amount of time investors have to hold an investment to receive the benefit of getting taxed at the lower rate.

The House bill makes it so that big investors have to hold an investment for three years to receive the lower rate, as opposed to one year as it currently stands.

What is most shocking about the House bill is that hedge fund billionaires will pay a lower tax rate on their income than the vast majority of working, middle-class Americans.

Under the House bill, Americans making $45,000 a year will pay 25 percent rate on their income, while hedge fund managers will still be able to pay the 20 percent capital gains rate.

“If you were designing something that perfectly avoids hitting private equity, venture capital and real estate, this would be it,” Victor Fleischer, a law professor at the University of San Diego, told The New York Times of the House’s bill.

“The real issue is that carried interest is compensation for services performed for the investment fund,” Fleischer said. “If you write a book, and it takes three or four years before you earn a royalty, that doesn’t make the income a capital gain. If a movie takes three years to generate a return, that doesn’t make it a capital gain. There’s no reason why financial services should be any different.”

The Senate’s proposal fails to do away with carried interest.

Some pushing the GOP tax bills think it already incentivizes investment and innovation through lowering the corporate income tax rate and individual tax rates, thus spurring economic growth.

Proponents of keeping carried interest believe that the provision is nothing more than a capital gain.

“Carried interest is a capital gain and should be taxed no different from other capital gains income. Lawmakers are considering a compromise between those who want higher taxes and those who want pro-growth policies that would increase the minimum holding period of carried interest capital gains from one year to three years,” Alex Hendrie, Americans For Tax Reform tax policy director, told The Daily Caller News Foundation. “Further increasing taxes on carried interest capital gains would hurt investment in the economy and those who rely on this investment for retirement.”

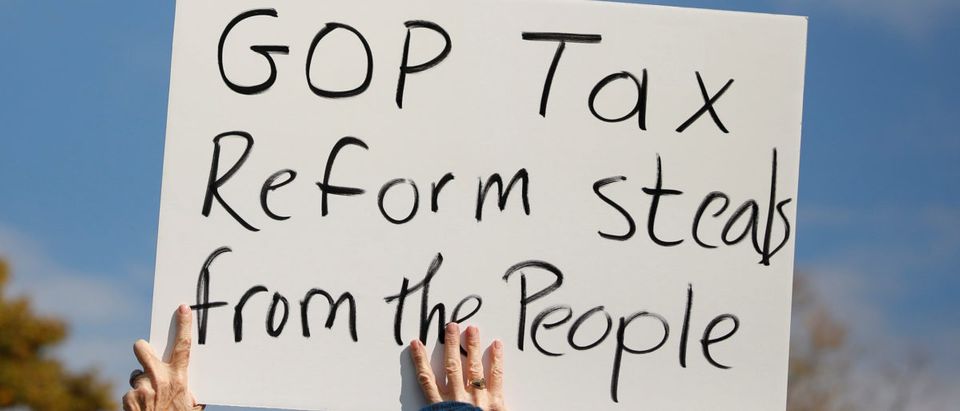

RELATED: Protesters Angered by Tax Plan March on Pence Event

Send tips to robert@dailycallernewsfoundation.org

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact licensing@dailycallernewsfoundation.org.