Ahead of the impending implementation of President Joe Biden’s latest student loan forgiveness plan, a new report published Wednesday alleges that the program is illegal and defies congressional authority.

Biden’s Saving on a Valuable Education (SAVE) plan is an income-driven repayment program that will cost an estimated $156 billion over the course of ten years and will go into full effect on July 1, according to Politico. A new report from DFI, a nonprofit focused on educational and labor policies, however, claims that the president’s plan is “illegal” and has “claimed legal authority far outside what Congress intended” when it approved the ability for the secretary of education to forgive limited amounts of student debt via income payments. (RELATED: Biden Forgives Another $7.7 Billion In Americans’ Student Loan Debt)

“Congress intended income-driven repayment to be a flexible repayment option with a last-resort loan forgiveness benefit that imposed negligible costs on taxpayers,” Jason Delisle, the report’s author, said in a press release. “The Biden administration’s SAVE plan runs roughshod over those intentions, and it may not survive pending legal challenges as a result.”

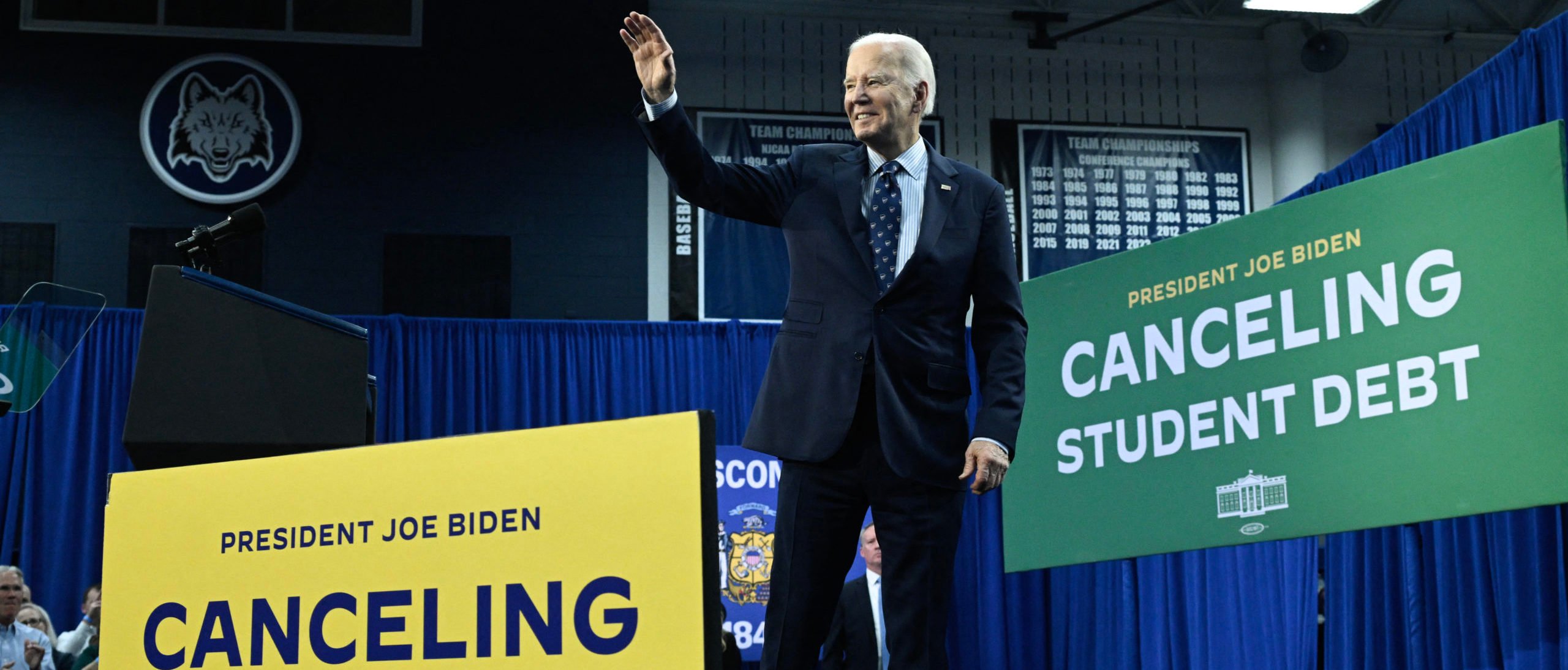

US President Joe Biden waves after speaking about student loan debt relief at Madison Area Technical College in Madison, Wisconsin, April 8, 2024. (Photo by ANDREW CABALLERO-REYNOLDS/AFP via Getty Images)

The SAVE plan sets payments based on 5% of an undergraduate’s income and also eliminates unpaid interest each month, according to the report. Total loan forgiveness can occur as soon as ten years into the program for those with debt under $12,000, whereas previously the plans required 20 to 25 years of payments before loan forgiveness was approved.

The report argues that when Congress approved income-driven repayments for student loans it did not intend for participants to “have balances canceled after 10 to 20 years of repayment, including months when their payments were $0.”

“Lawmakers did not originally intend for loan forgiveness to be a major benefit of income-driven plans and intended borrowers to repay for 20 or 25 years before having debt canceled,” the report states.

Additionally, the report claims that the law was initially intended to apply only to “low-income students” but that the Biden administration has done away with this provision and allowed the forgiveness to extend to students well into the middle and upper-middle class.

The Supreme Court struck down the administration’s previous attempt to enact widespread student loan relief for 40 million Americans in June 2023, ruling that the secretary of education did not have emergency authority to cancel student debt through the Health and Economic Recovery Omnibus Emergency Solutions (HEROES) Act.

“It’s a pattern with this administration to stretch the law to the breaking point, and then hope both that Congress will be gridlocked and unable to respond and that no one will challenge them successfully in the courts,” Jim Blew, a co-founder of DFI, said in the press release. “We hope the courts, if not Congress, will let the administration know it cannot create a plan like SAVE and use federal student aid to buy votes and cater to special interests.”

The Department of Education did not immediately respond to the Daily Caller News Foundation’s request for comment.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact licensing@dailycallernewsfoundation.org.