A study published Thursday found that residents in Democrat-run states are taking on more debt than anyone should ever have to, ever.

The survey conducted by WalletHub found that eight of the top 10 cities where residents are taking on insane amounts of credit card debt are located in Southern California, while the other two are in Pearl City, Hawaii, and Las Vegas, Nevada. Coming in the top was Rancho Cucamonga, where household credit card debt is estimated to average a little over $18,300, with total credit card debt being $1,054,741,861.

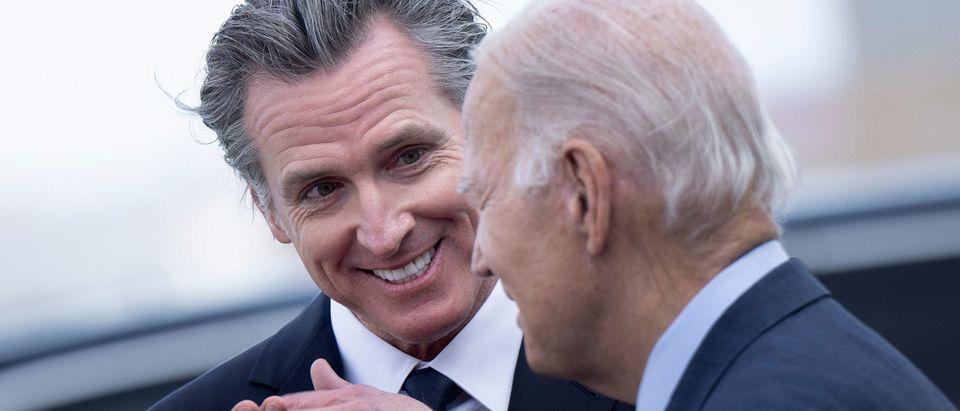

California is predominantly run by Democrats. The state has lost a slew of major companies and countless residents since the COVID-19 pandemic and is currently experiencing some of the greatest crime and humanitarian crises in American history. And now it can add a major economic crisis to its mounting pile of problems.

Americans have racked up around $1.3 trillion in credit card debt, some $108 billion of which was added in 2023 alone, WalletHub noted. Using data from Transunion and the Federal Reserve, and adjusting for inflation, the analysis also included an estimate of average income and credit scores within 180 U.S. cities.

In stark contrast, residents in predominantly Republican-run states took on far less credit card debt. Tennessee, Georgia, Alabama, New Mexico, Texas, Vermont, West Virginia, North Dakota and Alaska all had cities in the top 10 smallest increases in credit card debt.

One Of America’s Highest-Growth Cities Is Starting To Fracture https://t.co/myQgSSAepA via @dailycaller

— Tom Spencer (@trsmiami) January 29, 2024

WalletHub believes credit card debt will increase by at least $120 billion by the end of 2024, which would almost be a record-breaking amount. (RELATED: Not Even Uber Celebs Can Avoid The Catastrophe Of Real Estate Right Now)

The average household credit card debt per household is apparently $10,848. This figure does not include the extreme debt so many Americans have taken on in order to buy a home in the last couple of years. Thanks to sky-high interest rates and a desperate need to keep up with the Joneses, millions of Americans are living in homes they can’t afford, and won’t be able to afford if the economy keeps tracking this way.