Millions of American families will begin to receive monthly cash payments Thursday as part of the $1.9 trillion coronavirus relief package that President Joe Biden signed into law in March.

The payments are an expansion of the Child Tax Credit, and will continue for a year before requiring congressional renewal. As many as 90% of American families are eligible to receive hundreds of dollars a month for each child they have, and some experts believe that the policy could ultimately cut child poverty in half.

Further, the vast majority of eligible families do not need to do anything to receive the payments, according to the Internal Revenue Service, which is distributing them. But some families that do not file tax returns need to sign up to receive them, and the Treasury Department estimates that more than 2.3 million families may have to do so. (RELATED: Is The GOP Turning Into A Party That Supports Cash Relief?)

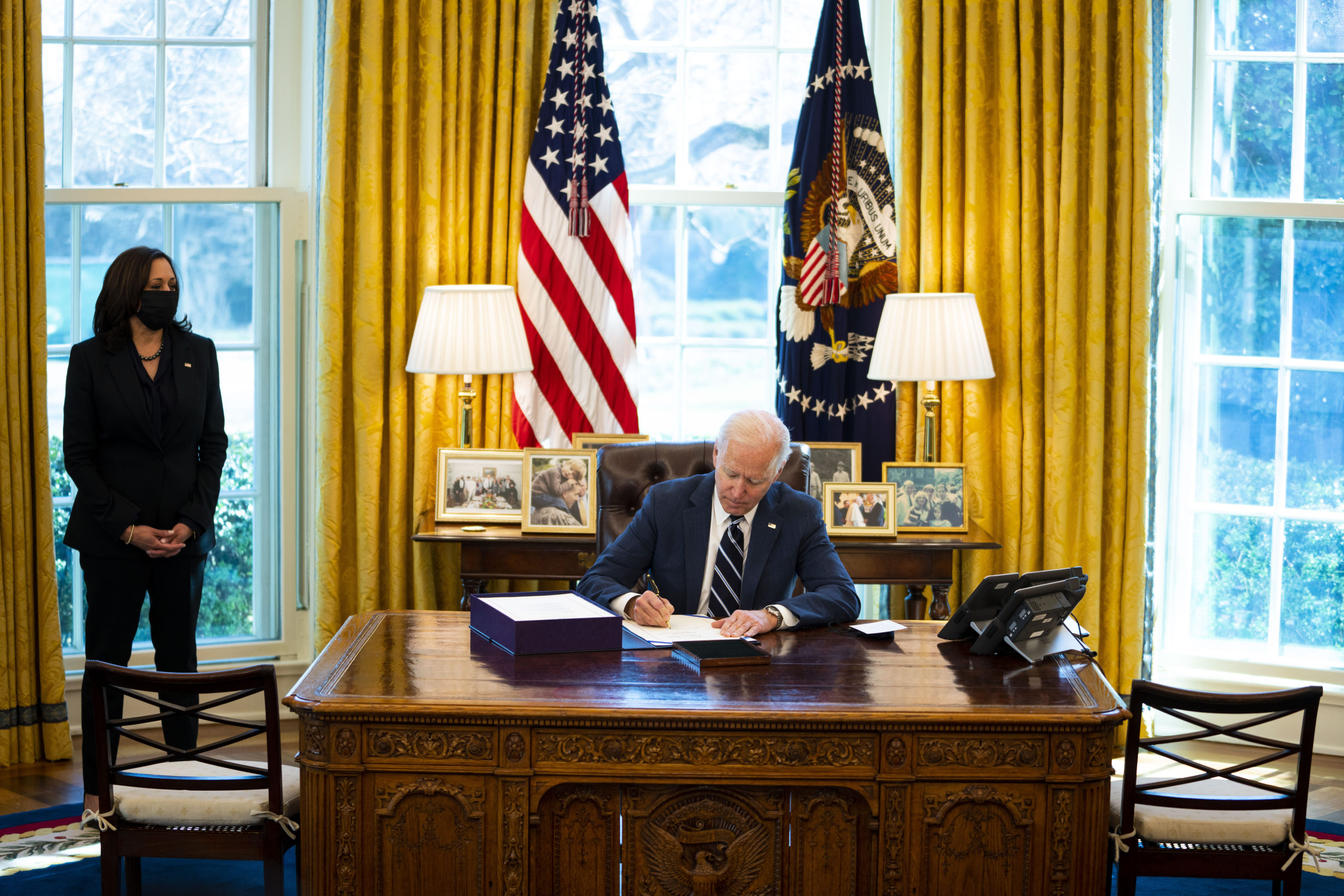

President Joe Biden signed the American Rescue Plan into law in March. It includes a yearlong expansion to the Child Tax Credit. (Doug Mills-Pool/Getty Images)

How Much Will Families Get?

Eligible parents are able to receive $3,600 a year for each child under six and $3,000 for each child under 18 for 2021, according to the bill’s text. Payments will be monthly, totaling $300 for families with younger children and $250 for families with older ones.

Unlike previous credits, this one is fully refundable, meaning families are eligible to receive it even if they do not have an earned income or do not owe federal income taxes.

The Child Tax Credit extension is also an expansion, since under previous credits families could only receive up to $2,000 per child per year.

Who Is Eligible?

Individuals with an income under $75,000 who filed a single tax return are eligible for the full credit, as are married couples with a collective income under $150,000 who filed jointly and those with an income under $112,500 and filed as their “head of household.”

Those payments begin to phase out for higher incomes and drop to zero at $240,000 for unmarried taxpayers and $440,000 for married couples, according to the Congressional Research Service.

The I.R.S’s “eligibility assistant” tool helps determine who is eligible, though those using it will need to provide tax documents like a W-2 or 1099.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact licensing@dailycallernewsfoundation.org.