The wealthy board of directors who presided over the failure of California tech lender Silicon Valley Bank (SVB) is suing federal regulators seeking billions, according to a bankruptcy court filing.

Despite their bank collapsing and receiving an estimated $16 billion rescue from the Federal Deposit Insurance Corporation’s (FDIC) taxpayer-backed Deposit Insurance Fund (DIF), SVBFG is suing the federal regulator for the nearly $2 billion it seized from the company after taking over SVB in March, according to the filing. SVB Financial Group (SVBFG) was SVB’s parent company and its board of directors oversaw SVB, its biggest asset.

The FDIC stated it has legal authority to keep the seized $1.93 billion in cash as it assesses the cost SVBFG should pay for the rescue, according to Reuters. SVBFG asserts that the FDIC violated U.S. bankruptcy law by retaining the money, according to the filing.

“These continuing violations are having a significant impact on the Debtor,” SVBFG wrote in the filing. “The $1.93 billion in Account Funds is the core estate asset. The Debtor’s lack of access to these Account Funds is impeding its ability to reorganize, and causing harm to the Debtor on a continuous basis.” (RELATED: Collapsed Bank’s Former Owner Sues Federal Regulator For $2 Billion After Massive Bailout)

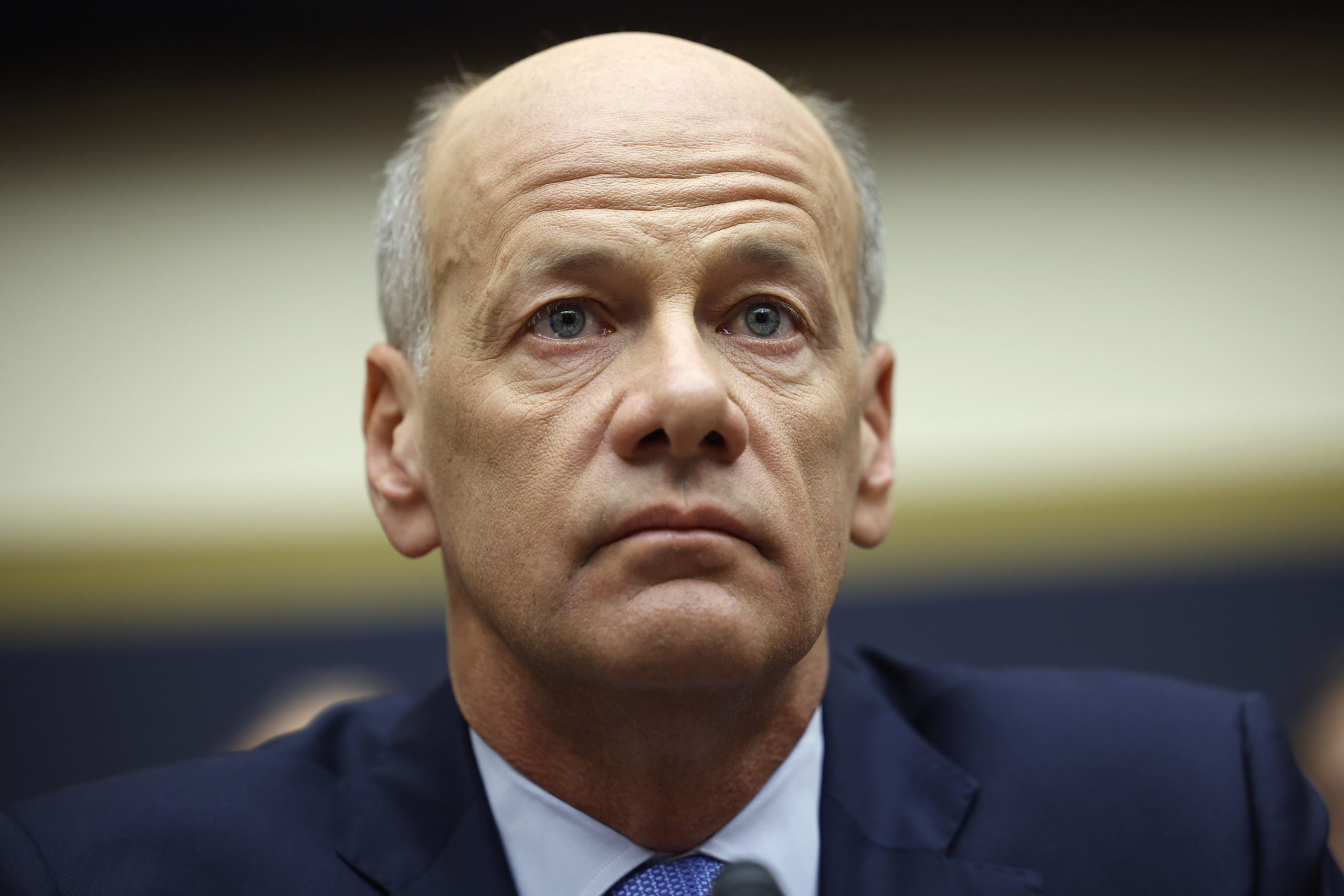

WASHINGTON, DC – MAY 17: Former CEO of Silicon Valley Bank Greg Becker testifies during a House Financial Services Committee Hearing at the Rayburn House Office Building on May 17, 2023 in Washington, DC. The hearing was held to examine the recent failures of Silicon Valley Bank and Signature Bank. (Photo by Kevin Dietsch/Getty Images)

The first takeaway of a Federal Reserve review in April on why SVB failed was that “Silicon Valley Bank’s board of directors and management failed to manage their risks.” Some members of the board of directors even served on SVB’s risk committee.

Board member since April 2010 and risk committee member Kate Mitchell owned 4,248 shares of SVBFG as of May 2022, according to SEC filings. Mitchell currently holds seven board positions, according to her LinkedIn profile. Another board member who served on the risk committee was Tom King, formerly CEO of Barclays Investment Bank, according to his LinkedIn profile. Further, Kay Matthews has been a board member since 2019 and was also a risk committee member, who owned 2,374 shares of SVBFG as of January.

SVBFG’s risk committee needed to sign off on the company’s contingency funding plan detailing its “strategy for dealing with liquidity needs during a stress event,” according to the Federal Reserve review.

Garen Staglin, board member since 2011, and chair of the compensation committee, owned 13,964 shares of SVBFG as of January and owns a 71-acre estate in California focused on creating rare wine, according to his LinkedIn profile. Eric Benhamou, board member since 2005, owned 5,455 shares of SVBFG as of May 2022.

SVBFG filed for bankruptcy in March, just days after its main business SVB collapsed.

SVBFG, Mitchell, King, Staglin, Matthews and Benhamou did not immediately respond to the Daily Caller News Foundation’s request for comment.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact licensing@dailycallernewsfoundation.org.