Fifteen of the world’s leading terrorist organizations regularly turn to black market tobacco for financing.

As developed countries embrace a slew of tobacco control measures such as higher taxes, raising the smoking age and plain packaging of cigarettes, the opportunities to profit from smuggling have exploded.

There are wide differences between the price of cigarettes both across Europe and between American states. While the intention of higher taxes has been to raise revenue and cut smoking rates the unintended consequences have been disastrous and terrorist groups are seizing the opportunity to profit by undercutting legal tobacco products.

Cigarettes are easy to smuggle, generate high profits and the chances of being caught are small and have relatively light penalties. As a consequence, tobacco has become big business for extremist groups.

France’s Centre for the Analysis of Terrorism (CAT) lists the Pakistani Taliban, Lashkar-E-Taiba, al-Qaida in the Maghreb, Hezbollah, Hamas, FARC and PKK, among others, as groups profiting significantly from tobacco smuggling.

“Recourse to this source of financing of transnational nature is facilitated by the existence of porous frontiers, weakness of Governments, an absence of checks and corruption. In some cases, especially war zones, cigarette smuggling is organised by terrorist or jihadist organisations under the guise of humanitarian aid (ex-Yugoslavia),” CAT state in its report on Financing Terrorism.

According to CAT, cigarette smuggling and trafficking represents more than 20 percent of terrorist financing of the groups identified. The report cites a host of cases from North Africa to Virginia of groups and individuals using tobacco smuggling to fund terrorist networks.

“It is seen that many jihadis are very close to petty crime (counterfeiting, smuggled tobacco, drugs),” said France’s budget minister Christian Eckert in 2015. According to sources inside Pakistan, terrorist groups in the war-torn Waziristan region derive between 15 and 20 percent of their budget from smuggling and counterfeiting tobacco.

Islamic State has set its face against cigarettes, going so far as to behead some officials for smoking. This hasn’t stopped ISIS from trying to profit from cigarette smuggling.

The Turko-Syrian border has seen a surge in illegal cigarette smuggling – doubling since the start of the Syrian civil war, according to official sources. Similar trends have also been reported on the frontier between Kurdistan and ISIS-controlled territory in Iraq.

Law enforcement efforts to curb the illicit trade have proven ineffective at substantially reducing levels of production and distribution. There have, however, been some successes.

According to a Department of State report published in December, 2015, operation Black Poseidon, which targeted the illegal tobacco trade in Eastern Europe, led to the discovery of a covert cigarette factory in Sumy, Ukraine which was concealed in an underground complex.

The factory is estimated to be capable of producing between 100,000-125,000 packs of cigarettes per day. The raid managed to seize 30 tons of cut tobacco and 350,000 ready-to-sell individual cigarettes pack with an estimated value of $560,000.

Estimates for the loss to U.S. state and local governments due to the illegal tobacco trade range from $2.95 to $6.92 billion. The European Union loses between $8.7-11.8 billion annually. Globally, the tobacco black market is estimated to be worth $40-50 billion.

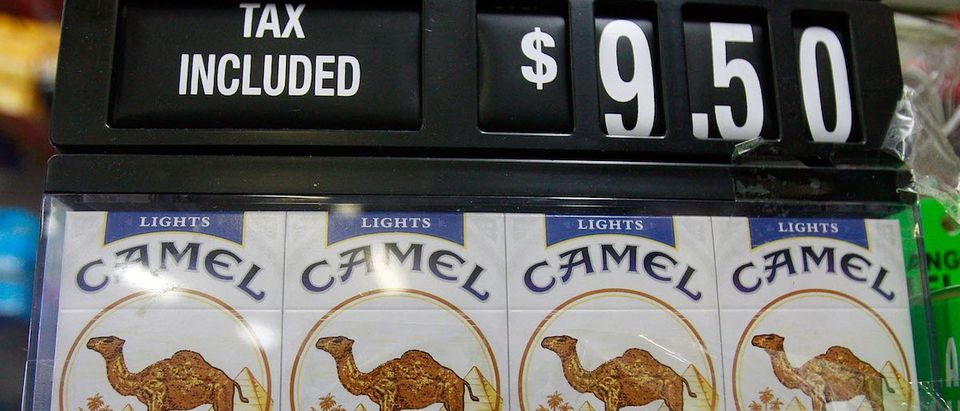

New York is reaping the whirlwind of sky-high cigarette taxes with a wave of smuggling decimating the state’s revenue. The average pack of smokes in New York City costs around $10.60.

New York raised taxes on cigarettes to $4.35 in 2010 from $2.75. In total, cigarette taxes have increased by 190 percent since 2006. The sharp rise has resulted in a raft of unintended consequences which are dealing a significant blow to the state’s finances. (RELATED: New York Loses $400 Million After Imposing The Nation’s Highest Cigarette Tax)

New York State Comptroller Thomas DiNapoli reports New York’s revenue from cigarette taxes has plunged by $400 million over the past five years. According to The New York Post, a separate study by National Academies of Sciences, Engineering, and Medicine shows the state lost a hefty $1.3 billion in uncollected taxes each year because smokers switched to cheaper alternatives.

Send tips to guy@dailycallernewsfoundation.org

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact licensing@dailycallernewsfoundation.org.