I can no longer sit quietly and watch this country implode from all of the Washington corruption.

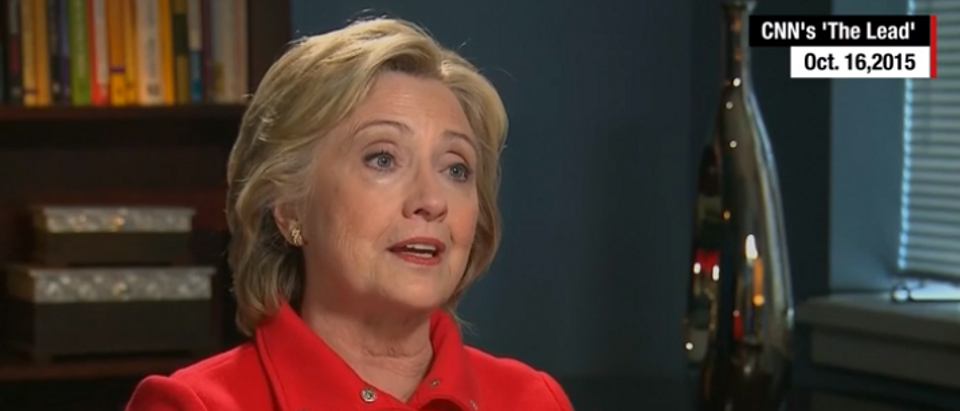

Today I watched Hillary Clintons speech and I was appalled. I watched her tell the audience how she would bring Wall Street to heel and hold them accountable. I listened to her say how she would use Dodd Frank legislation to manage that process. It is all complete BS.

Hillary is fully aware of the large scale bond fraud uncovered in Puerto Rico. A criminal conspiracy so large that it calls into question all $70 billion dollars of Puerto Rican debt. Hillary is calling for a complete bailout and supports current legislation to do just that.

The Puerto Rico Senate held investigative hearings in early 2015 to explore the financial failure of one of its largest municipal agencies. One government executive after another testified under oath that they knew they were technically bankrupt when they issued these bonds and could not pay them back. The witnesses then went on to say that although the credit agencies (Moody’s, Fitch and S&P) knew they were insolvent, they could secure good credit ratings for the bonds for the “right fee.” According to the same testimony, Wall Street’s biggest banks knew all this but for the “right sales fees” they would sell these junk bonds as safe retirement income to their retired investors.

The SEC has already performed four full audits on four bond issues and found the audits to be consistent with the Senate testimony. These agencies were insolvent and it could not have been accidentally overlooked by the Rating Agencies and the Banks.

We have seen this before with the 2007-2008 CMBS (mortgage bonds) crisis. The Rating Agencies and the Banks almost prefer to support these failing agencies because it forces them to refinance debt they can’t pay off as agreed before they have to admit it to their bond holders. This “Ponzi Scheme” forces frequent and costly refinancing on a regular basis, generating huge fees for the Rating Agencies and Banks. All good, if you can continue to refinance fast enough and bring in new investors quick enough to pay off the old investors. As in the case with Puerto Rico and other States and Cities, even a small hiccup causes the hold house of cards to collapse.

It is pretty clear that the Agencies issuing the bonds, the Rating Agencies issuing fraudulent ratings and the Banks selling junk bonds all broke the law and violated almost all of the provisions of Dodd Frank.

All Congressman and Senators were issued this information. Most did nothing but those that did, quickly stepped up to protect their Wall Street contributors. You see if this got out, the Rating Agencies and Banks would be held accountable for the tens of billions in bond losses. Politian’s and government employees may be charged criminally.

To date, there has been over $30 billion dollars in bond losses from this scam. The average bond holder owns less than $10,000 in bonds and that represents over 20 percent of their total savings. Not hedge funds, as the press and our political leaders would have you believe. When these bonds collapsed, after the senior citizens lost half their money, then the hedge funds came in to buy these bonds at 33-50 cents on the dollar with the hope of making money in the future. The hedge funds are being used as a distraction to take the discussion away from the original crimes. Most Puerto Rico bonds are still held by individuals like you and I.

New York residences owned the single biggest piece of this debt at about $4 billion dollars, followed closely by Florida, New Jersey, Pennsylvania and Illinois I don’t think any state has loss less than a few hundred million dollars. It is not a Puerto Rico Fraud. It is a National Fraud.

In this case it gets even worse. The Politicians were not happy stealing tens of billions from America’s middle class senior citizens when there is more to be taken. Enter the PROMESA legislation. Legislation that removes all existing legal rights from the innocent bond holders. The legislation actually prevents the bond holders from suing. All supported by politicians that know all about this.

Being around Washington for so long I know what most of these government officials did before securing their government jobs.

Treasury Secretary Lew and his legal counsels Weiss and Campbell worked for Citibank and Lazard respectfully. In the period that this fraud started Citibank and Lazard were among the first firms to sell these fraudulent bonds. Now using their position in government, all three of these gentlemen used their position in the Treasury department to market for a full bailout of Puerto Rico with Tax Payer Dollars and the innocent bond holder’s money later in the process. Not once in all the committee meetings they participated in did they site this conflict of interest while purposing solutions that benefit all their former employers.

Paul Ryan a professed conservative, was not supportive of any bailout or the PROMESA legislation. That is until he met with Secretary Lew. After the meeting, Ryan supported the legislation that violates every core principal that the Republican Party stands for. What happen? I suspect two things. Lew reminded him that he had a bright career and Wall Street would not forget this (contributions for his continued career advancement) and immediate funds for his current reelection campaign. I as guessing about the former but if you look at the contributions that flowed into him from Wall Street firms after the meeting, well it was impressive. Not surprisingly, most of the contributions came from firms directly involved with Puerto Rico.

It is clear that the Democrats has a strategy in place to redirect what’s left of the bond holders money to fund the unfunded government (union pensions). How will they do this? It is simple and the Press is going along with it. Claim that the bonds were issued fraudulently and claim they shouldn’t be paid back to the bond holders. Float stories that the bond holders are just greedy hedge funds and not people like you and I. Who likes hedge funds? Float stories that Puerto Rico is canceling services from lack of money. Kids are dying in the streets. You have heard all this before.

As a debt expert I should point out that when a family does not make its mortgage payment, that family has more cash at the end of the month, not less. Puerto Rico has withheld hundreds of millions in payments and has more cash than you would imagine. Any canceling of services is just another strategy being employed by less than honorable people.

I should mention in closing that Elizabeth Warren (who claims to be anti-Wall Street) knew all about this but was the first to propose an amendment to an energy bill preventing innocent bond holders from suing. Just follow the money for Elizabeth.

This is not just a $70 million-dollar scam (Puerto Rico) it includes Chicago, Connecticut and many other States. This is a political strategy to make up for years of over spending. When legal taxes are no longer enough, steal the bond holders’ money. Individually the bond holders are not very powerful and they will not understand what their leaders are doing to them.

Richard Lawless is a former senior banker who has specialized in evaluating and granting debt for over 25 years. He has a Master’s Degree in Finance from the University of San Diego and Bachelor’s Degree from Pepperdine University. He sits on a number of Corporate Boards and actively writes for a number of finance publications.