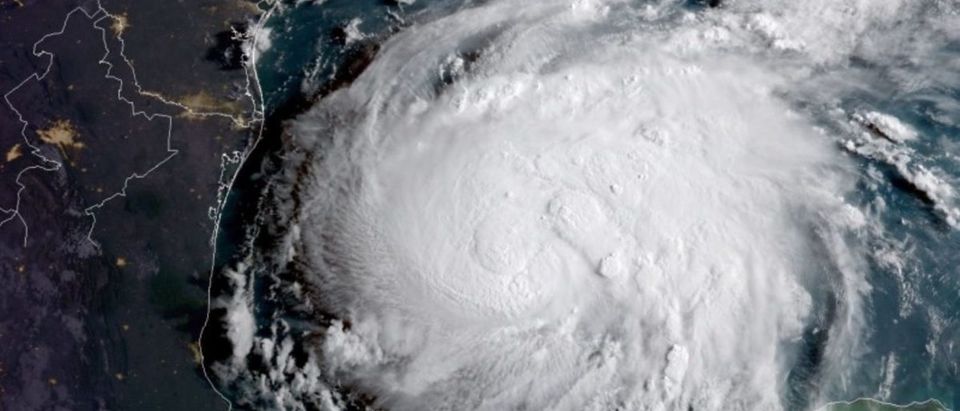

Energy markets are in turmoil after Hurricane Harvey struck Texas late Friday, knocking out oil refineries and crude production along the coast.

About 30 percent of the United States’ refinery capacity is made up of Texas coast oil refineries, and Harvey knocked out at least half of them. Experts are predicting a gasoline price spike as a results, The Wall Street Journal reports.

Refineries were shuttered in preparation for the storm.

The damage done hasn’t been fully assessed, but if the plants are offline indefinitely, international gas producers will have to pick up the slack left by Harvey’s destruction.

“Global refining margins are going to stay very strong,” Petromatrix managing director Olivier Jakob told Reuters. “If [U.S.] refineries shut down for more than a week, Asia will need to run at a higher level, because there’s no spare capacity in Europe.”

Countries producing gasoline that meets U.S. standards may have an opening to export to the U.S., at least for a time, as the U.S. oil and gas industry repairs the damage from the hurricane.

“We already heard that some Asian refiners are trying to send gasoline to the U.S., this is in addition to the traditional European supply, so I think some refineries in the U.S. might take time to restart,” energy consultancy Resource Economist Ltd. director Ehsan Ul-Haq told WSJ. “I think for a couple of weeks the U.S. will need supplies from all over the world.”

The price of crude oil is falling with demand of crude as less refineries are demanding it. Gasoline prices, though, are bumping up because less refineries are processing enough crude to keep up with current prices, according to WSJ.

Harvey is weighing down already struggling stock prices of energy companies. Stock prices had fallen 5.7 percent by Friday before the hurricane hit. The natural disaster is expected to knock stock prices down even lower, WSJ reports.

August is expected to be the biggest monthly fall in the price of energy stocks since 2015, according to WSJ.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact licensing@dailycallernewsfoundation.org.